To review hard money lenders, a borrower should consider five different factors: Loan programs, Qualification Requirements, Processing speed, the lender's Communication, Knowledge and Control, and Deliver what was Promised. The interest rate and fees are not always the most crucial element of a loan. The loan officer's friendliness and promise of a great interest rate are meaningless if he could not complete the loan on time.

The lenders' five ranking factors

We are analyzing 5 separate factors to come up with the lender combined score

| Lender's Score |

|

| Details: |

|

| Loan Programs |

|

| Qualifications |

|

| Processing Speed |

|

| Communication Knowledge Control |

|

| Deliver what was Promised |

|

1. Loan Programs

Rate &Terms -of course, you want to have a lender who offers low-interest-rate, long loan duration, many options of amortization type, low monthly payments, and no prepayment penalties.

Great loan programs depending on your qualification, and if you do not have a perfect financial profile, the best possible Rate &Terms programs will be out of your reach.

Highest Loan Amount- In some cases, borrowers are willing to compensate Rate & Terms for a higher loan amount. To get to a higher loan amount, the lenders should have programs with higher LTV and or higher LTC

Cash-out- For a particular situation, the amount of cash-out the borrower can get out of the loan is more critical than Rate &Terms. Maximum Cash-Out is not always the same as getting the highest loan amount. Many lenders have restrictions on cash-out because they consider cash out as a risk. If max cash out is your primary objection, find lenders who offer:

- Loan with high LTV.(For construction and Fix N' Flip - loans with high LTC.)

- Blanket loans, using an additional property with collateral to secure the loan and get you all the cash you need.

Lenders who offer various great programs based on the borrower's needs and financial strength deserve a 5-star rating.

You could save many hours of searching the best Rate&Terms by using Lendersa® loan requests to instantaneity and simultaneously search thousands of loan programs for the best match for your financials and needs.

2. Qualifications

Qualifications are credit, income, verifications, cash in the bank, and 15 other factors. Conventional lenders and banks usually require tax returns and strict verification of all income and assets. Portfolio lenders can accept bank statements and other forms of income verification instead of tax returns, and Hard money lenders can arrange loans based only on equity.

Lenders who have reasonable Rates & Terms but only have a few loan programs narrowed to specific borrowers' profiles could become a liability when they discover that the borrower does not meet the exact underwriting guidelines during processing. The qualification of the borrower is not completed until the entire underwriting is done. There could be hundreds of reasons why a pre-qualified loan or even pre-approved loan by a lender will not get final approval. Therefore working with mortgage brokers is in some cases better than working directly with a lender. A broker can shop the loan to several lenders and quickly shift to another lender in case of any qualification problem.

Lenders who offer a large variety of loan programs with qualification options based on the borrower's needs and financial strength deserve a 5-star rating.

You could save many hours of searching lenders who offer a variety of loan programs with alternative verification methods by using Lendersa® loan requests to instantaneity and simultaneously search thousands of loan programs for the best match for your financials and needs

3. Processing Speed

How long does it take to get a loan? We all like to get things done fast. Conventional bank loans can take 30 to 90 days to fund. Hard money loans can be completed in 10-30 days. In extreme situations, the 5-star hard money lenders can close loans in as little as 3-5 days, providing the borrower with substantial equity in the property and a clean title.

In some cases, the speed of closing is much more critical than Rate &Terms. The lost opportunities stemmed from the inability to close fast enough could be ten times bigger than the benefits of low-interest rates and low fees. For example, an $80,000 profit from flipping a distressed property was lost because the buyer wasted time trying to shop for low interest instead of getting a fast hard money loan.

You could save many hours of searching the best Rate&Terms by using Lendersa® loan requests to instantaneity and simultaneously search thousands of loan programs for the best match for your financials and needs.

4. Communication, Knowledge, and Control

Borrowers are usually stressed out when waiting for the lender's approval. All stress comes from not knowing what will happen, when, and how. A good loan officer knows that he must keep extraordinary communication with the borrower. Regardless of any decision or any problems, the loan officer should communicate and be available 24/7 to answer questions no matter how trivial. The loan officer may need to explain the process once twice or ten times, and he should do it with a friendly and positive attitude. If the lender cannot approve the loan after exhausting all options, the loan officer must communicate immediately to the borrowers and suggest possible solutions or other lenders. When in doubt, communicate to the borrower.

Email -emails are great for transferring data and files. Emails are bad to solve upsets

Texts- texts are excellent for the fast exchange of information and acknowledgments. Texts are faster than emails and quicker than phone calls. Texts are bad for complex situations, and handling any major upset

Phone- Phone calls are a must for any complex situations and solve mild emotional issues

In-Person- Face-to-face meetings are the best form of communication but not always possible and take lots of time from the lender and the borrower.

You could save many hours of searching the best Rate&Terms by using Lendersa® loan requests to instantaneity and simultaneously search thousands of loan programs for the best match for your financials and needs.

5. Deliver what was Promised

Lenders who deliver what was promised are five-stars lenders. It is not always possible to deliver what was promised, and it is not always the lender's fault because the promise was made based on a data set provided by the buyer. During processing, it becomes evident that part of the data was inaccurate, and the lender can no longer deliver what was originally promised.

Bait and switch

Unfortunately, some eager beavers and new loan officers will tell you that you are approved just to lure you into starting a loan process. When you are deep into the processing and out of time, they change the original offer to a less desirable loan than they originally promised.

To solve this problem, when time is of the essence, you should always have a backup lender or several lenders who can step in and give you the loan you need when the original lender does not perform.

You can find up to 6 backup lenders by using Lendersa® loan requests to instantaneity and simultaneously search thousands of loan programs for the best match for your financials and needs.

Hard Money Lenders Reviews

The review table indicates how to review lenders on each factor of loan origination:

|

|

|

|

|

|

| Loan Programs |

A large variety of loan programs short and long duration with many options, including blanket loans. Low rates and fees with various prepay options |

|

|

|

Only a few loan programs. Rate & Terms below average. No flexibility with programs |

| Qualifications |

Many qualification Options. Including loans based only on equity and loan to people with bad credit. |

|

Difficult qualification procedure. Requiring strict documentation without any alternative options |

| Processing Speed |

Very fast and clear |

|

|

|

Very slow and confusing |

|

Communication

Knowledge Control

|

24/7 by phone, texts, emails, and in-person. Give meaningful advice to improve the loan. Make the entire loan process smooth and without stress |

|

|

|

Not returning phone calls, texts, and emails. Does not explain, confuses. Make the loan process a mysterious and stressful experience |

|

Deliver what was Promised

|

Loan amount Rate & Terms, and the entire loan procedure was as portrayed initially or even better |

|

|

|

Made false promises lie about the capacity to arrange loans |

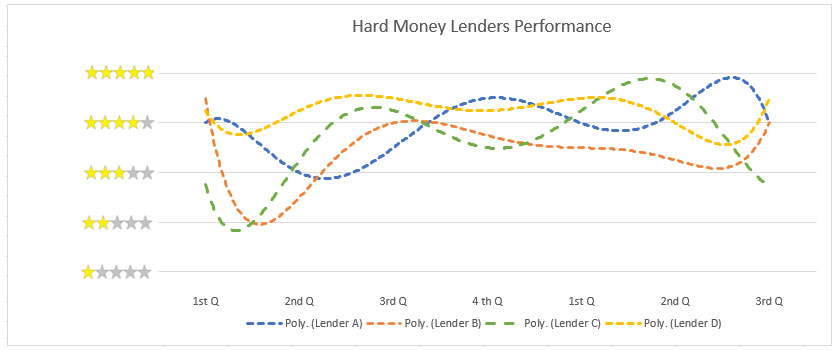

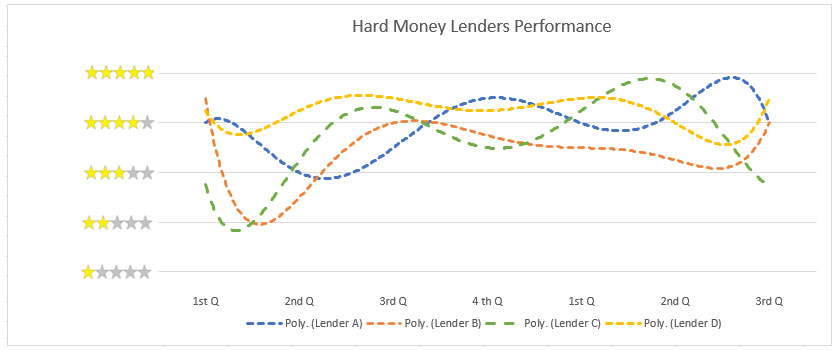

Hard Money Lenders Evaluation Issues

Performance Fluctuations

The rating of hard money lenders can change over time.

Reasons for changes are:

- Change of loan officers

- Management change

- Private Investors change

- Market change

Hard money loan officers could be the difference between getting a loan approved or disapproved. An experienced loan officer can control not only the borrowers but also influence the investors.

Other reasons for changes are an increase or decrease in available funds to lend and market changes that affect the investors' mood. There are reasons see hard money secrets

Reviewing hard money lenders is different than reviewing restaurants, home services, or products. The experience of getting a loan can be very stressful, and the stress can affect the abjective judgment by the borrower of the lender's performance. A very low score can be view with a grain of salt. Also, any 5 stars review could be suspicious since it requires a high theoretical standard that is almost unobtainable. Because of the nature of private money and every loan scenario's unique situation, the only lender who can fund your loan might have a low score.

Hard Money Reviews handling

You can read reviews on Yelp, Google or other review sites. Reviews of conventional lenders or FHA loan lenders are a lot more meaningful than reviews of hard money lenders. If you request a loan and receive many replies for your hard money loan request, you will have the luxury of ignoring all hard money lenders with bad reviews. If you are getting back only one or two replies from lenders who had bad reviews, you should proceed with caution and optimize the loan request to get additional lenders.