Why is it impossible to figure out how to get a better loan without Lendersa®

To compare and analyze data, you first need to have access to the data. Lendersa® holds Rate sheets and guidelines of thousands of loan programs. Even if you have access to the data, you will still need to compare it against your financial information, the property, and your goals. There are too many factors to consider without a strong computer brain. That’s true for a single loan program let alone millions! Below is a list of the most common items which either help you or stop you from getting a loan.

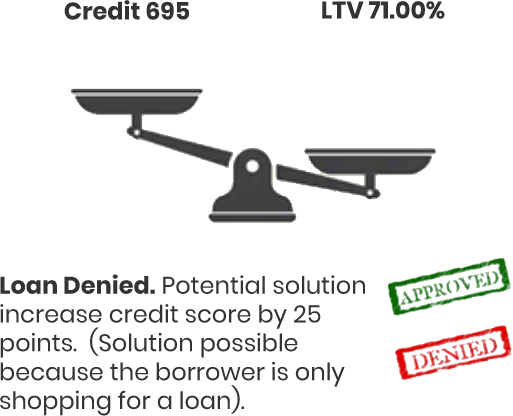

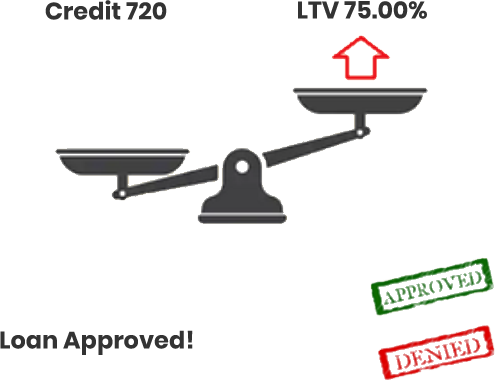

These are some of the items which will help you with getting your loan. The more, the better:

- Credit Score

- Verification of Income

- Income

- Job stability

- Down Payment

- Property Good Condition

- Liquid assets

- Equity in real estate

- Exit plan

- Experience (For non-owner, rehab loans)

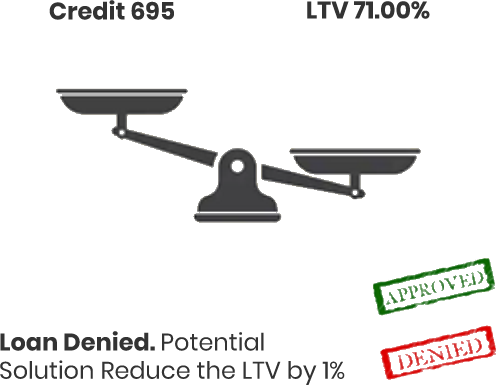

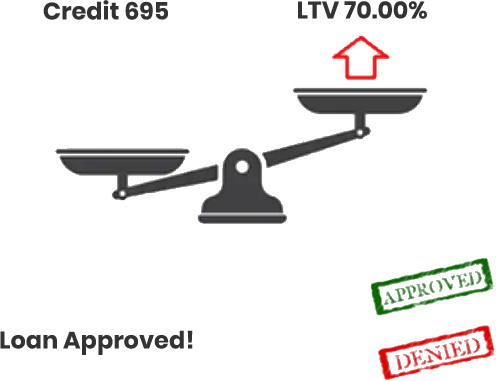

These are some of the items that will prevent you from getting your loan. The less you have, the better you are:

- LTV (Loan To Value Ratio)

- Loan Amount

- DTI (Debt to Income Ratio)

- Expenses

- Loan to Cost (mainly for loans involving constructions)

- Bankruptcy, Foreclosure, Short Sale

- Mortgage obligations

- Other debts obligations (Credit Cards Installments)