How to get private hard money loans approved

The first thing to know about getting your loan approved

by lenders is that lenders are eager to arrange loans and will help you with

your loan request to their qualification limits.

Understanding the qualification limits is the key to any

successful loan funding. The other factor is how to pitch your loan request to lenders.

What are Qualification Limits?

The qualification limits, also known as underwriting guidelines,

are the combined maximum and minimum qualification factors each lender sets as

a guideline. If the combined factors fall within the lender's policies, the

lender will approve the loan. If the combined factors exceed the lender's

guidelines, the loan is considered too risky from the lender's point of view,

and the lender will decline the loan.

The Most Critical Qualification factors

The most common reasons your loan request does not match

with lenders are:

Requesting a loan with too high an LTV

Having too low a credit score

Insufficient Income to debt-service the loan.

The LTV is the most critical factor for hard money loans,

followed by credit score.

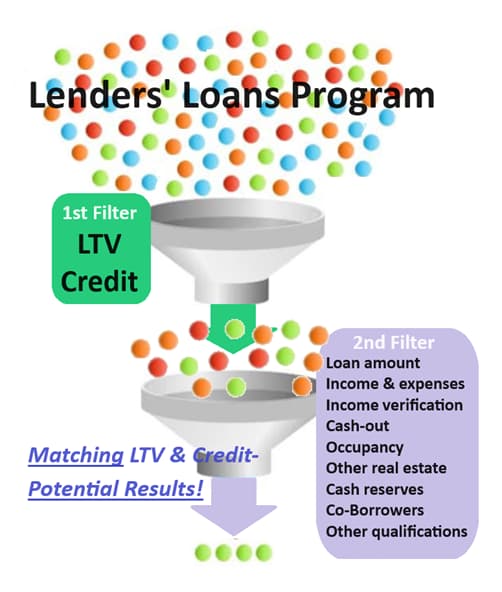

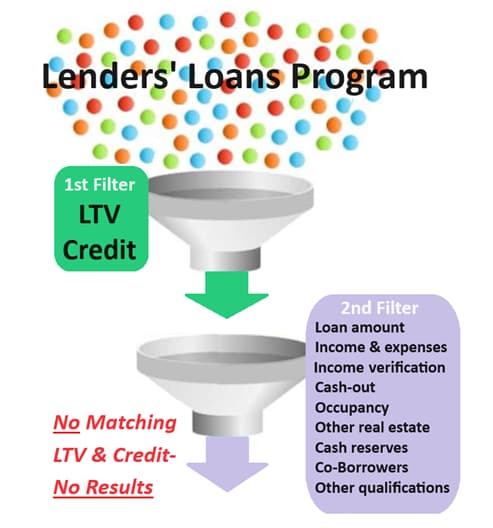

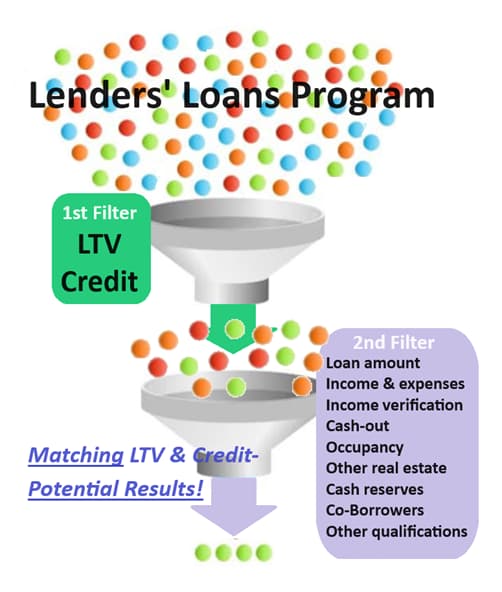

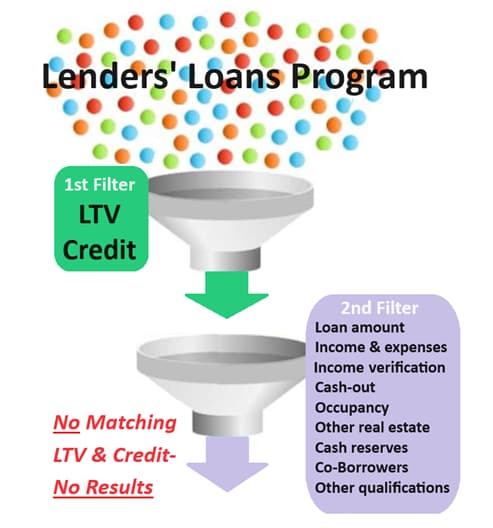

Your loan request acts as a filter for thousands of loan programs from our lenders. Those with too high an LTV (Loan to Value) or too low a credit score will not get matching programs.

If you get no matching lenders, the first

thing to check is the LTV, followed by credit.

This table shows the Minimum credit for LTV ranges

required for hard money loans.

A. Reduce the LTV by adding another real estate property with

equity.

B. Add a co-borrower with good credit and show the

co-borrower's credit in the loan request.

C. Use the Lendersa® loan optimization engine to find

solutions for matching with lenders

Other factors lenders consider

If you can get the LTV/ Credit in the correct range, you

open the door to get your hard money loan. But there are 10-30 additional factors that

could prevent or enhance your chances for better rates and terms.

Use the lendersa Optimization engine to improve your

chance for a better loan, and follow the instructions in this blog.