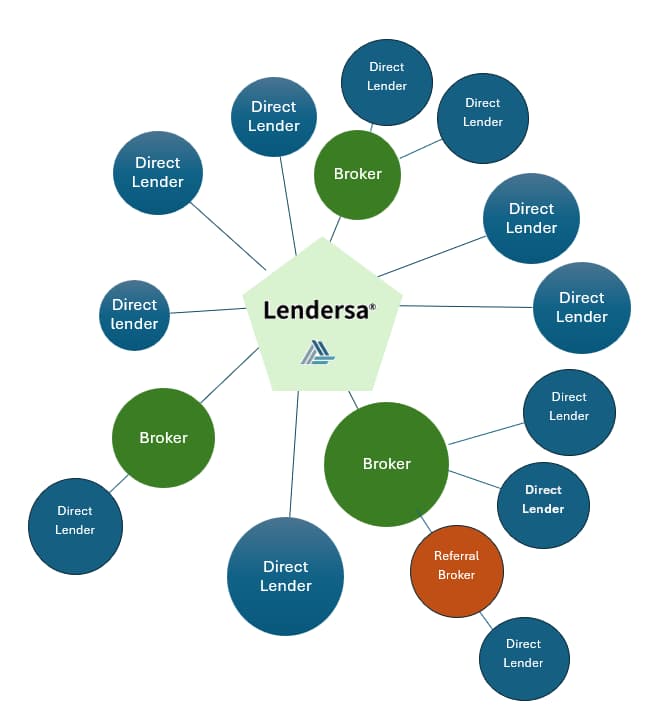

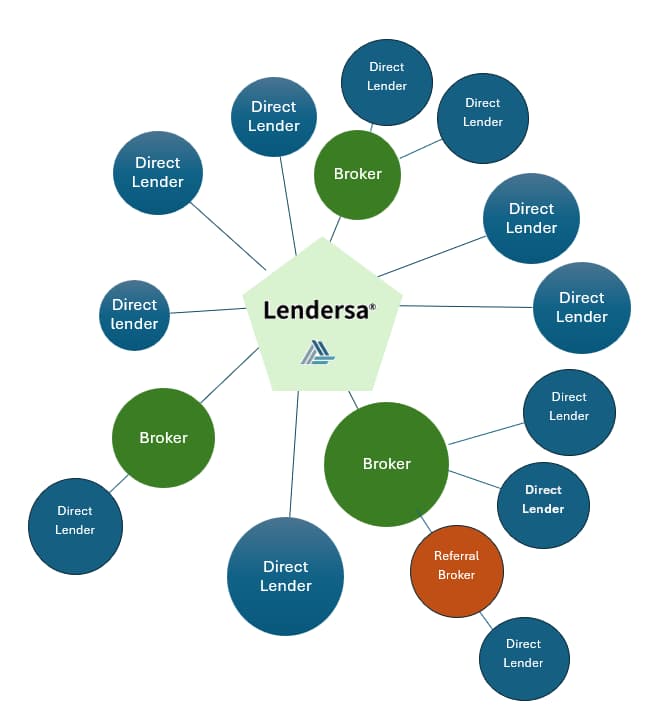

Find out the different types of lenders and how they

interact to fund hard money loans. This blog sheds light on the web of brokers

and lenders cooperating to fund a private hard money loan and their

relationship.

Lender definition from a Borrower point of

view

Borrowers usually do not distinguish between "Brokers,"

"Lenders," "Investors," "Direct Lenders, or "Referral

Lender"." Borrowers' goal is getting their loans approved and funded;

the term "Lender" could mean anyone who facilitates that goal.

Lender definition from a broker's point of

view

Brokers define a lender as the entity that approves and

funds the loan, i.e., a Direct Lender.

Direct Lender (

Funding Lender

A direct Lender is the entity that approves and funds the loan. Direct Lenders don't always use their own money, but they have the ability to draw loan documents and fund loans from their controlled pool fund or Private Investors. Direct Lenders get the loan package directly from the Borrower or via an Originating Broker or Referral Broker. Sophisticated borrowers and brokers who shop for loans on behalf of their borrowers' clients always ask, "Are you a direct lender? " There are lots of benefits to Brokers shopping for loans to get a Direct Lender. Borrowers can sometimes fair better with an experienced loan broker who will eventually produce a better loan for the Borrower by shopping and negotiating the loan with multiple Direct lenders.

Loan Package

Loan Packages should minimally include a basic loan

application, credit report property profile, and information on the borrower

loan purpose and exit strategy. A complete loan package will have bank

statements, leases, and documented income information, like tax returns, explanations

of credit derogatories, preliminary title reports, and, if possible, appraisal

or BPO. Since many Direct Lenders require that they order the appraisal themselves,

loan packages are often presented to Direct Lenders without an appraisal report.

Mortgage Brokers

Are licensed individuals or companies who solicit loans,

process loan packages, and shop them to Direct Lenders. Experienced Mortgage Brokers

establish relationships with Direct lenders and know where to and how to

present the loan package most favorably. Mortgage Brokers could simultaneously

deliver the package to several direct lenders and negotiate the best rate and

terms on behalf of the borrowers. Brokers can also act as Direct lenders.

Brokers who are also Direct Lenders

Some Brokers can act as Direct Lenders for certain types

of loans while being Brokers for other kinds of loans. It could happen that a

lender, acting as a Direct lender, starts underwriting a loan with the intention

of using his own private investors and then transfers the loan package to

another Direct Lender who actually funds the loan.

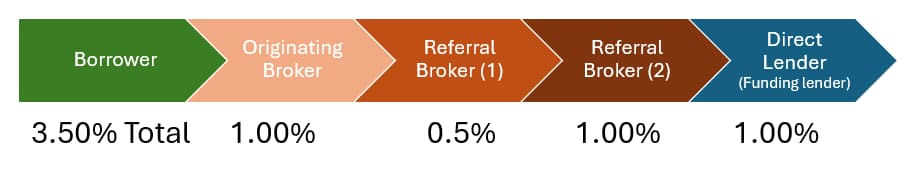

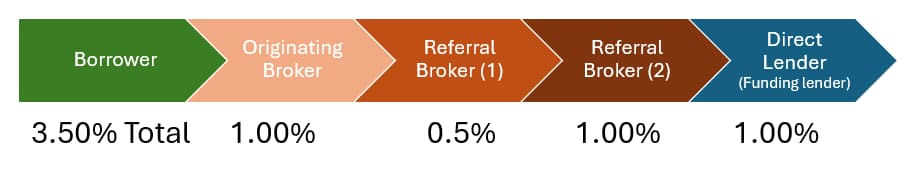

Brokers Chains

A Broker-Chain

comprises an Originating Broker, at least one Referral Broker, and a Direct

lender. Broker- Chains are not necessarily bad and sometimes are the only

method by which the loan can close; however, the entities who are part of the

chain should know their exact position and exact compensation for their relative

work/ connection.

In the graphic, the total commission of 3.5% is split among the originating broker, the two referral brokers, and the direct lender. The commission split is different from loan to loan. It depend only on the agreement among the broker/ lenders on the chain.

Originating Broker

The Originating Broker is the broker who was first in

contact with the Borrower. The originating broker creates a loan package and

sends it to the direct Lender or to a referral broker/lender. Originating Brokers

always try to reach direct lenders and avoid referral brokers. The reason

behind it is to maximize their commission and have better control of the

transaction. An apparent Direct Lender often who can't fund the loan could give

up or sometimes become a referral lender; thus, a Broker Chain is created.

Referral Brokers (Referral Lenders)

Any broker or Lender part of the brokers' chain becomes a

Referral Broker. Referral Brokers can do a lot of underwriting work, gathering documents

and applications before presenting them to another lender or several lenders. In

some cases, the Referral brokers do not underwrite but only transfer a package already

prepared by another broker or the basic information submitted by the Borrower. The

Originating Broker is also always a Referral Broker.

Brokers Pretending to be Direct Lenders

Some Brokers mislead themselves as Direct Lenders to

attract business; this could create confusion and waste time as it creates a unanimous

broker chain.

Private Investors

Private investors are individuals who are using their

money to invest in loans. Private Investors are not directly connected to the

borrowers because of the licensing requirements, and they fund the loans via Direct

Lenders who underwrite the loans and arrange all the legal disclosures needed.

Some Private Investors with Broker/ Lender licenses could fund the Borrower,

but this is rare.

Wholesale Lenders

Wholesale Lenders are direct lenders who fund loans only

through loan brokers. Wholesale lenders do not interact directly with the

borrowers. Many wholesale lenders have a parallel Retail division that accepts

loan applications directly from borrowers.

Retail Lenders

Retail lenders are Direct Lenders accepting loan

applications directly from borrowers and bypassing all broker interventions. Some

Retail lenders also have a wholesale division accepting loans via brokers.

What is better for the Borrower, retail, or

wholesale Lender ( via a broker)?

It all depends on the loan complexity. With a simple loan

request going directly to a retail lender, the Borrower gets a direct

interaction with the money source, fast approval, and maybe saves a little on

the loan fees. With a complex loan, a good Loan Broker can

better present the loan request to the Lender via the wholesale division. A Broker

will also try several lenders instead of one to get the best possible rate and

terms.

Referral Brokers (Referral Lenders)

Any broker or Lender part of the brokers' chain becomes a

Referral Broker. Referral Brokers can do much underwriting work, gathering documents

and applications that the Orinating Broker has not already collected. Once the

package is completed, they will forward it to one or more Direct Lenders. In

some cases, the referral brokers do not underwrite but only transfer a package already

prepared by another broker or the basic information submitted by the Borrower.

Mixed Lender definitions

Depending on their role in a loan transaction, brokers

and lenders could have several designations applied to them.

For example, a Broker can be a Direct Lender, a Retail

Lender, a Wholesale Lender, or a Referral broker.

Loan Lending Cycle

A Lending Cycle

depends on the type of loan origination

Simple Borrower to Direct Lender

Borrower to Mortgage Broker

Borrower to Mortgage Broker with Referral Broker