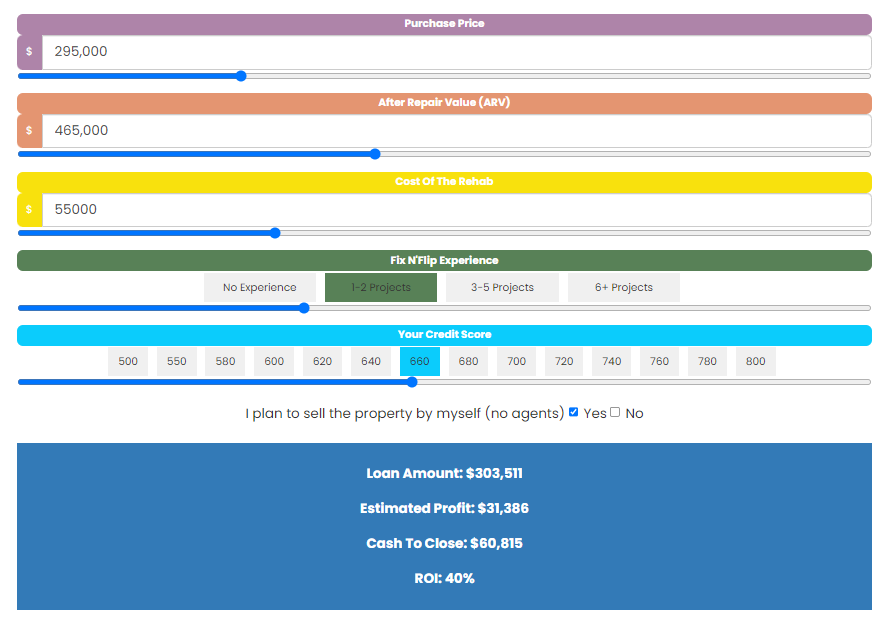

Commercial real estate investors and business owners often find themselves in need of additional funds to finance property improvements, purchase new assets, or expand their business. In such cases, a commercial equity loan can be a viable solution. By leveraging the equity they have built up in their commercial property, borrowers can access a lump sum of cash to meet their financial needs.

A commercial equity loan is similar to a commercial cash-out refinance, as both involve refinancing the property to access funds. However, while a cash-out refinance provides a one-time, lump sum amount, a commercial equity loan allows borrowers to access funds as needed. This flexibility can be beneficial for businesses that have varying cash flow requirements or for real estate investors who may need funds for property rehabilitation or acquisition.

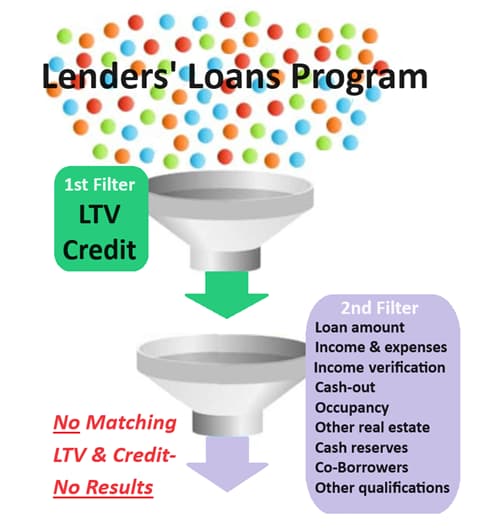

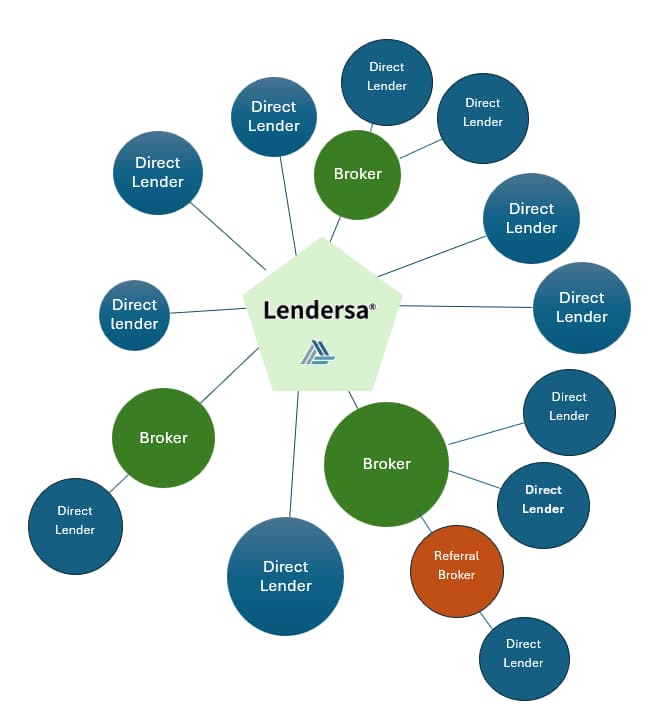

To secure a commercial equity loan, borrowers need to evaluate their property's equity, gather the necessary documentation, and apply with multiple lenders to compare