Lendersa delivers good hard money leads that are vital for the prosperity of every hard money lender. The leads are fresh, high-quality, 100% matching, and 100% guaranteed, which means if you don't close the transaction, you do not need to pay a dime!

Why lenders need leads?

Good hard money leads are lifesavers for all lenders and especially for lenders who have investors' money ready to lend and need to place those funds fast. Regardless of the lenders' marketing budget or the length of time they are in business, mortgage leads are the bloodline to every broker and lender. And for wholesale lenders, Lendersa provides connections to hard money brokers and real estate agents close transactions.

What makes a good mortgage lead?

- Fresh- real time

- The loan scenario is matching your loan program

- The borrower expectation of Rate & Terms parallel the lender's Rate and terms

- Lead management

- Guarantee of success

- Bridg loans lead

- Commercial, residential vacant land leads

- Fix and Flip Leads

- Business purpose leads

- Leads for bad credit or good credit clients

- Local leads in your city or your county

- You only pay if you close the deal!

Fresh mortgage lead

You get the lead the instant the borrower completed the loan request. Speed of delivery is essential for all mortgage leads, and it is ten times more important when it comes to hard money leads. Borrowers seeking private loans are often under time pressure. Hard money borrowers are willing to pay high interest and high points as long as they get their financing done expeditiously. The private lender who reacts the instant he receives the request has a better chance of getting the loan than somebody who responds days later.

At Lendersa, we deliver the leads to you by email and by text to make sure you can reply immediately. You could also see the leads live on the Lendersa lead map.

Lead scenarios are matching precisely your loan program

To avoid wasting time dealing with loans that you can't deliver, Lendersa filters the lead to your exact specification.

E.g., When you ask for leads under 60% LTV, you shall get only leads under 60% LTV.

E.g., When you ask for the loan amount to be at least $200,000 and not higher than $900,000, you will get only leads between 200,000 to $900,000.

E.g., If you specify a credit score of a minimum of 620, FICO, you will get only borrowers with credit of 620 FICO or more.

Get more information on Lendersa® lead generation FAQ

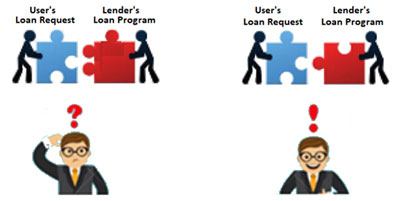

Lendersa Loan Input Program (LIP) system guarantees your lead quality

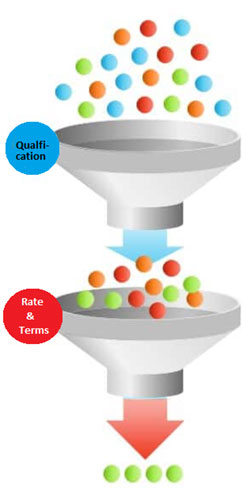

Your Loan Input Program (LIP) is acting as a dual lead filter. You will receive only leads that are matching your loan programs. The double filter filters two things:

A. The qualification requirements for the loan

B. The borrowers' expectations for rate&terms.

In the filters graph, the green balls

represent the good leads (Good leads = leads that are matching your loan programs' matrix and Rate and terms, precisely.) Lendersa® filters out all the loan requests that don't exactly match your loan program.

represent the good leads (Good leads = leads that are matching your loan programs' matrix and Rate and terms, precisely.) Lendersa® filters out all the loan requests that don't exactly match your loan program.

The Qualification Filter block all unmatching qualifications

The borrower's request and your loan programs must match:

- Property Type (7)

- Subtypes (55)

- Location (2)

- Max LTV

- Min Fico

- property condition

- Loan amount

- Loan position

- Income and expenses

- income verification

- cash out

- Citizenship

- Occupancy

- Eligibility

- Funding time

- Reserves

- other real estates

- Cash reserves

- Bk and foreclosure

- Purchase or refinance

The expectation filter eliminates any unmatching borrower's expectation

- Interest Rate

- Points

- Prepay penalty

- Loan Duration

- Extension options

- Monthly payments

- Speed of funding

- Loan program

- Amortization type

As a result of Lendersa® precise matching between your loan programs and the borrowers' loan requests, you get highly qualified leads. Each lead must pass the qualification test of your program's matrix and match the pricing you offer with the borrower's expectations.

Lead management

To make it easy for the lenders to manage the leads, we built a lender's dashboard from where you can follow up on all your pipeline and control each loan, not to miss any opportunity. You will receive notices on each lead the second it is generated. In addition to email, you could get the lead texted to your phone to start a conversation with the borrower.

Guarantee of success

If you don't close the loan, you don't pay for the lead. Lendersa guarantee is simple if you close the loan, you pay for the lead, and if you do not close the loan, you don't pay for the lead. The lead price is a tiny fraction of your commission, and it depends on the loan size and other factors. To find out about our hard money leads or our mortgage leads, log into your account or register as a lender now. Registration is Free. You must have a real estate license or other licenses that enable you to arrange loans in one or several States.

Beyond hard money, mortgage leads

Lendersa membership is FREE. The high quality of mortgage leads is guaranteed, and there are additional benefits for becoming a member:

- Advanced placement in Lendersa hard money directory

- File transfers to wholesale hard money lenders

- Access to hard money sources

- Access to hard money private investors

- B2B connections to lenders

- Connect to investors

- Links to your website increase your SEO

- High-quality lead guarantee

- Custom dashboard to manage your leads

- Hard money lenders become conventional lenders

- Conventional brokers become hard money lenders

- Connect to conventional, FHA, VA USDA wholesalers

- Connect to reverse mortgage lenders

- Get commissions from Non-Qm owner-Occupied lenders

represent the good leads (Good leads = leads that are matching your loan programs' matrix and Rate and terms, precisely.) Lendersa® filters out all the loan requests that don't exactly match your loan program.

represent the good leads (Good leads = leads that are matching your loan programs' matrix and Rate and terms, precisely.) Lendersa® filters out all the loan requests that don't exactly match your loan program.