Lendersa® Loan Optimization Engine

The essence

of Lendersa® loan optimization is to get your loan approved and to see that you

are getting the best possible rate and terms. The optimization proposes solutions to make one or

more changes to your loan request to:

A. Get your loan approved or

B. To improve

the rate and terms if your loan is already approved.

Optimization

Options

Several options

could be available to increase your loan chances for approval or a better loan.

Among the most common options are:

Slightly

reducing the loan amount

Raising

the appraised value (3 methods)

Adding

another property with equity

Slightly

improving your credit score

Changing

the method of verifying income

Adding

Income source with a Co-Borrower

Sorry, you

can't do it without Lendersa®

To

effectively discover what options are available, you first need to know all the

underwriting guidelines of hundreds of Banks, Credit Unions, and private

investors. Since each Lender has several loan programs, understanding and

comparing them to your needs is overwhelming. When you try to compare 3 or 4

lenders, your job will get exponentially more complicated. And comparing over

100 lenders is humanly impossible.

Trying to

find your options alone without Lendersa®

Optimization Engine is impractical.

When no matching programs are found, the Lendersa®

Optimization Engine AI looks for the “almost

matching” loan program and will propose solutions! That process takes seconds.

How does the

Lendersa® Optimization Engine works?

Lendersa® checks the fitting combinations

of 20 factors for each loan request; Optimization Engine instantly finds the

closest matching programs, the "almost matching" programs, and

presents them to you as potential solutions. If you agree, it will make the change, and you

will see the pre-approved rate & terms. To demonstrate with an example, we

shall take a loan request that is not yet approved because no match was found.

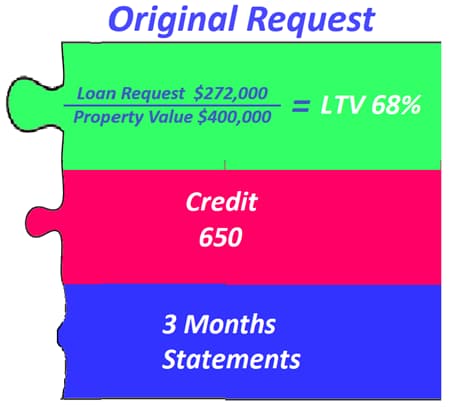

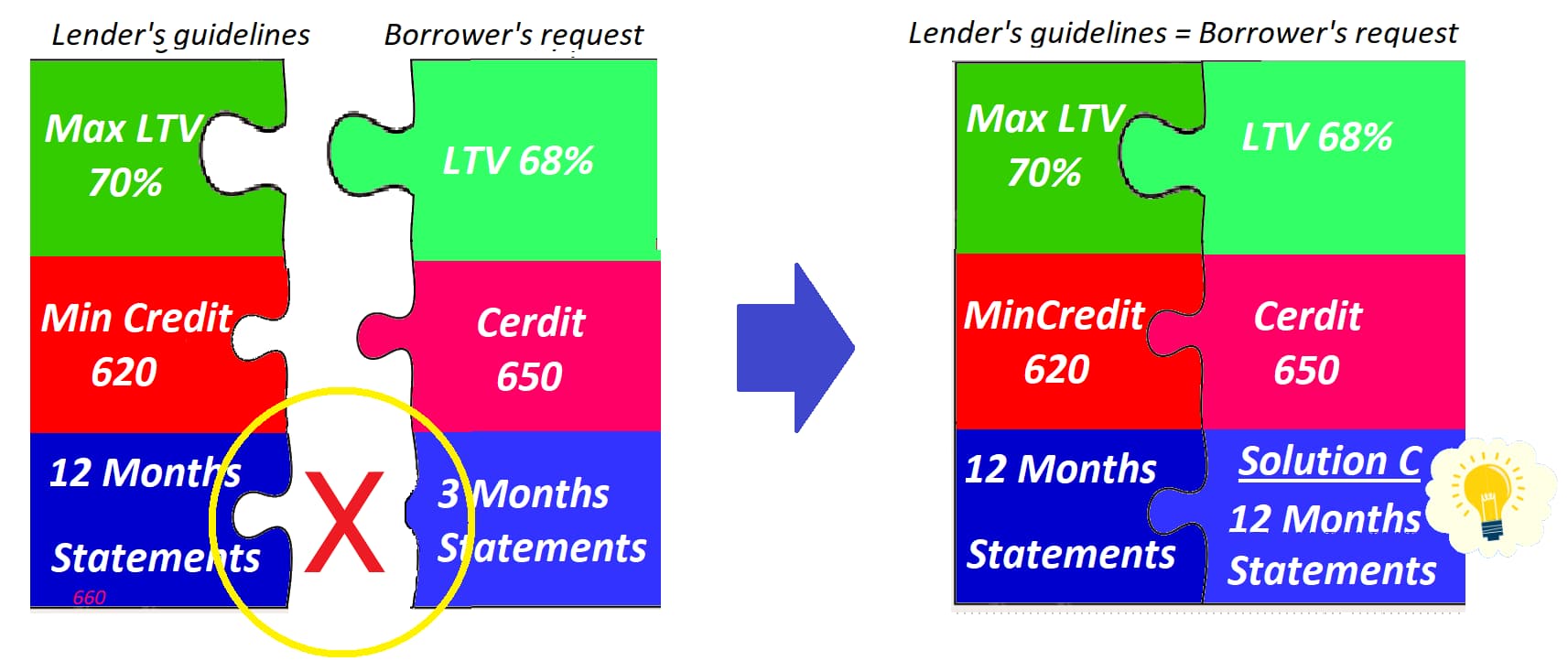

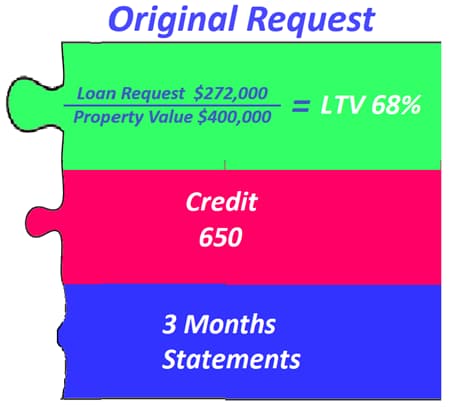

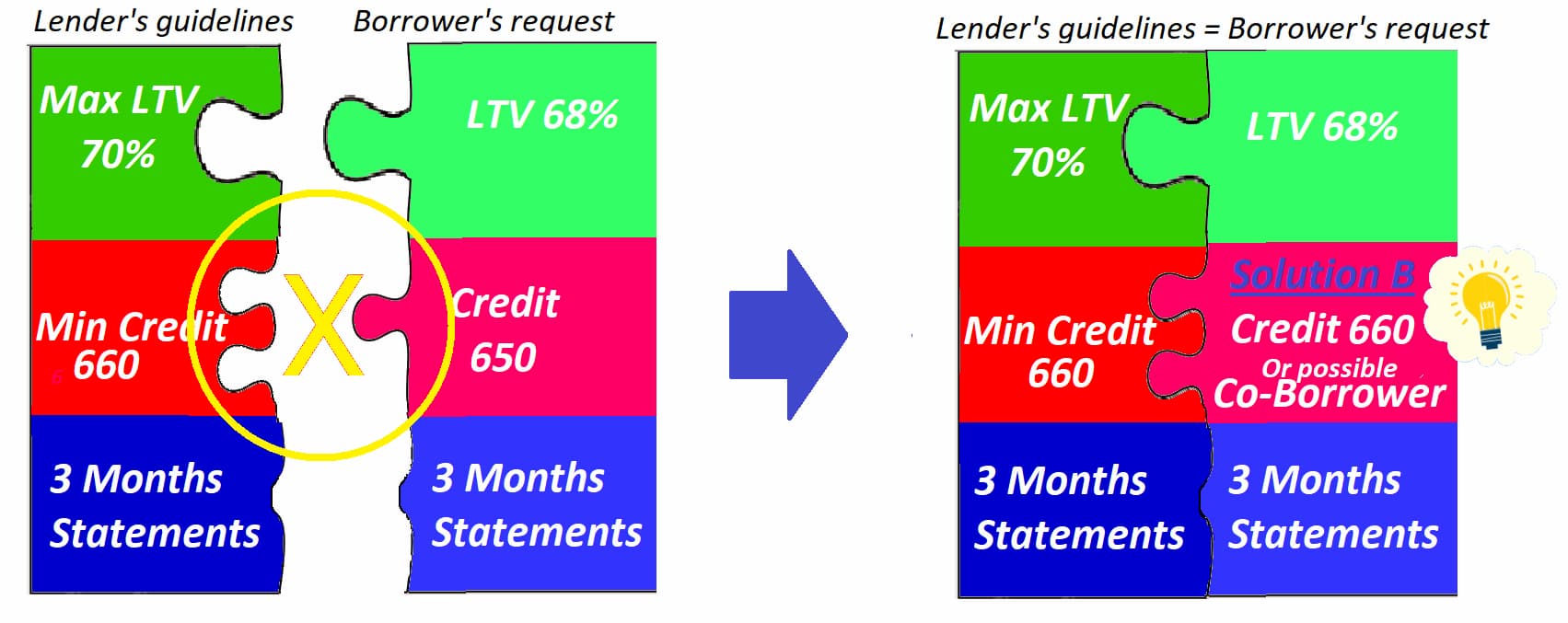

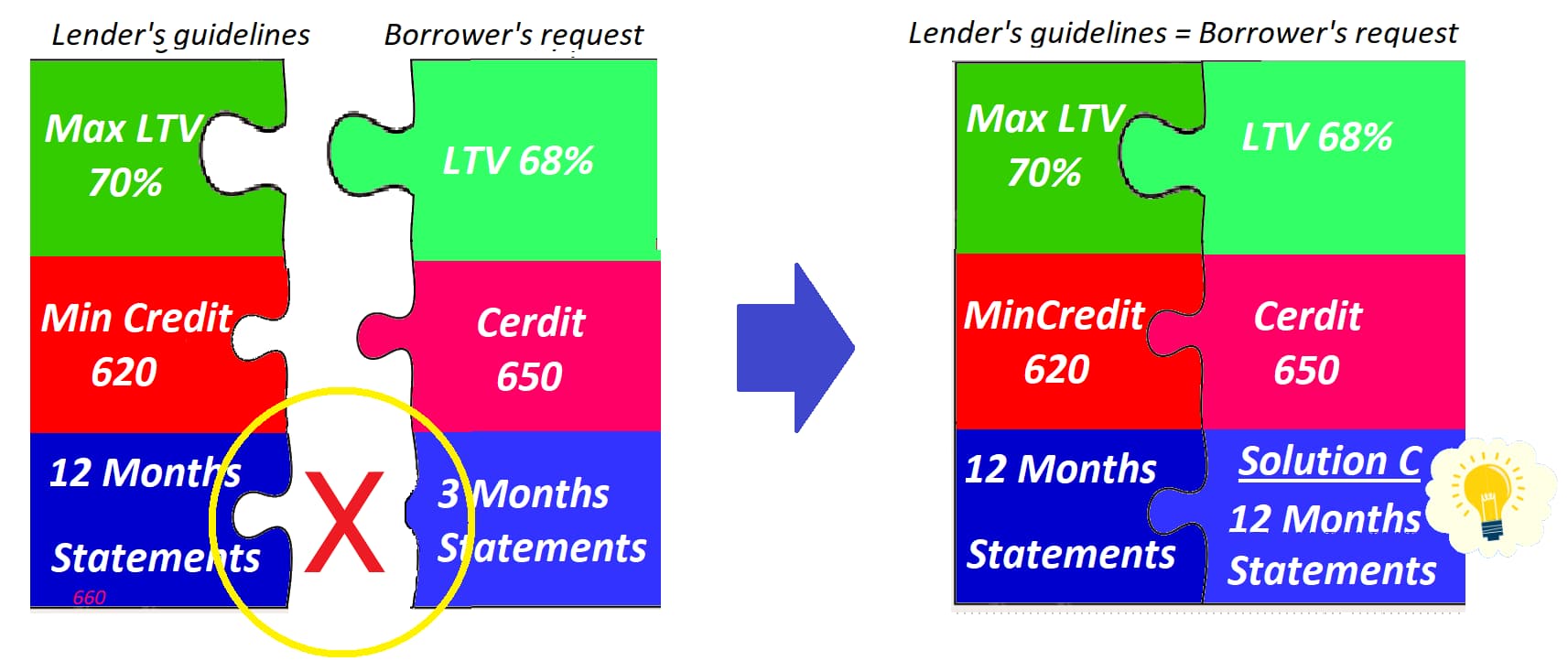

We show only three factors to simplify the demonstration instead of the 20 Lendersa® optimized; we will use only LTV, Credit, and Verification.

Let's look at the loan request as a piece of a puzzle with three prongs:

LTV, Credit, and Verification. The loan will be approved if the borrower's

3-prong puzzle piece matches the lenders' loan program. If not, no worries; Lendersa®

's Optimization Engine instantly finds the closest matching programs, the

"almost matching" programs, and presents them to you as potential

solutions.

Tiny changes = Better terms and savings on rates and

fees

Changing the loan requests can be very small, yet the results can be

spectacular. Lendersa®

Optimization

Engine discovers a loan program with almost a match.

Let’s look

at the loan scenario that is not yet approved.

Borrower

David wishes to refinance his house and pull $52,000 cash to renovate the

property. David's existing loan is 220,000

The Loan

David request is for $272,000

David shows

his house value as $400,000

The Loan To

Value (LTV) is the ratio between the loan amount and the property value, and in

David's case is 68% ($272,000/$400,000=68%)

David's

middle Credit Score is 650

David can

verify his income with the three latest bank statements.

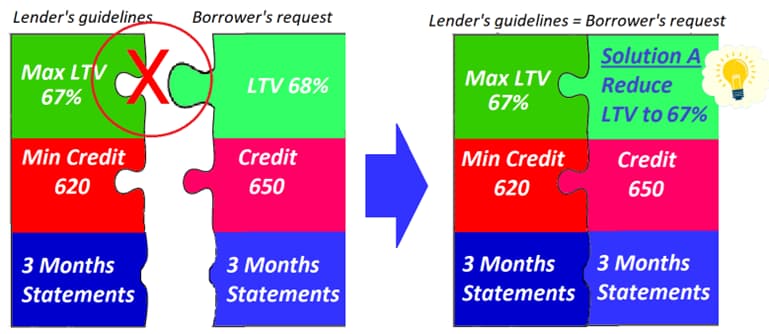

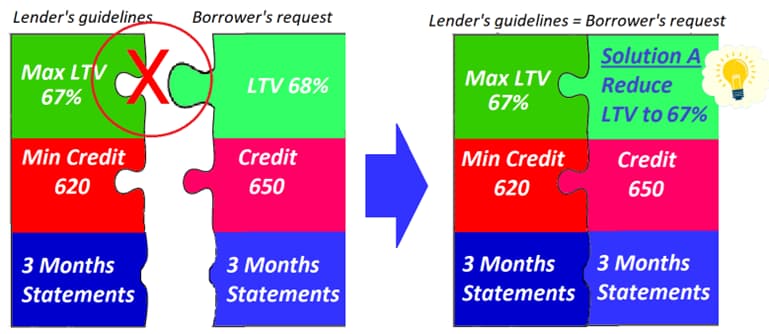

Solution One- Reduce LTV by 1%.

The Program Max LTV is 67%, and if David reduces the LTV by only 1% from 68% to 67%, a match will occur, and the

loan could become approved.

To achieve this solution, all that

is required is one click to accept the solution, and the software will change

the loan amount from $272,000 to $268,000. There is only a $4,000 difference in

the loan amount to get a lender's approval. David will see the option, and all

he needs to do is click on it and accept it, and Lendersa® will change the loan request and connect David

to the Lender.

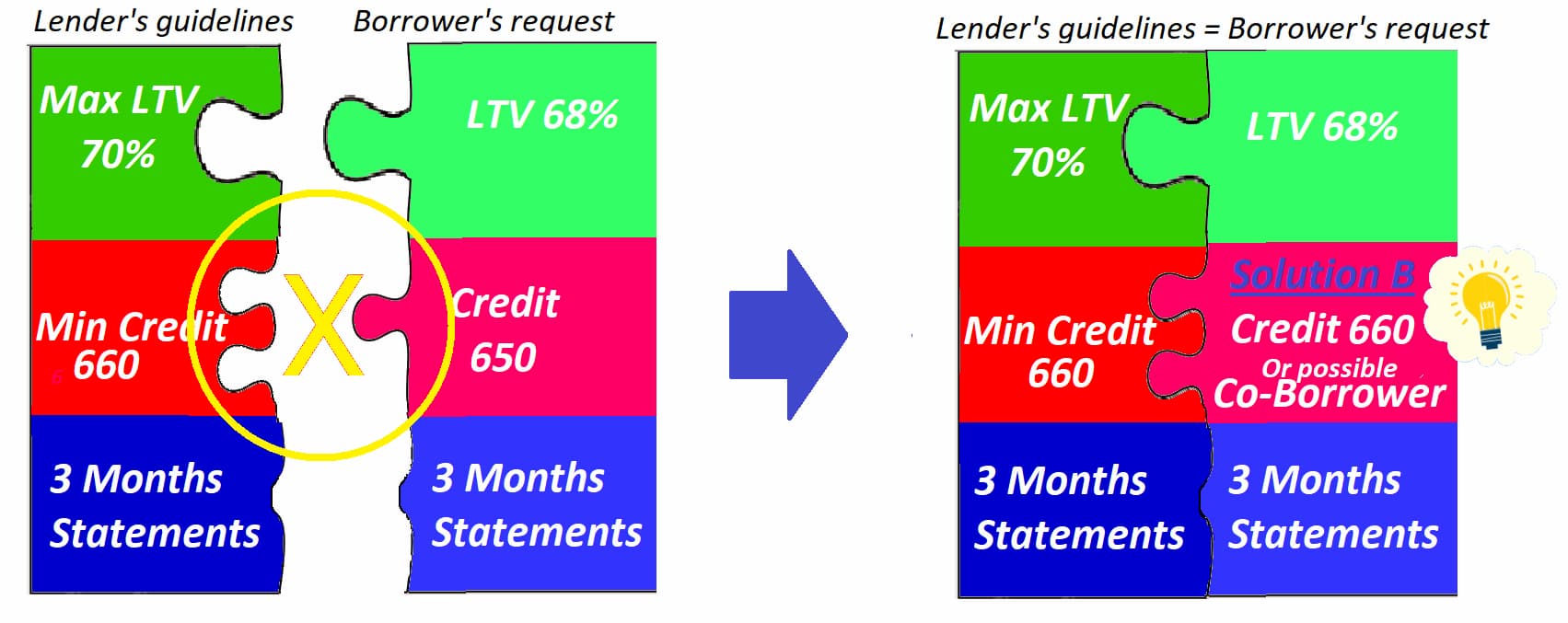

Solution Two- Increase the credit score by 10 points

There is a program that matches all aspects of David’s loan request

besides the Credit Score, which must be at least 660. Increasing a credit score by 10 points can be

done quickly by paying down credit cards or other means. David can also add a

Co-Borrower with a higher Credit Score.

Solution Three – Verify with 12-month

statements

There are several ways to verify income.

The best way is to fully document the income with two years of taxes W2,

and other documents. Full-docs is the

bank standard, and those who can verify their income with taxes will enjoy the

best rate & terms.

Subprime lenders, aka Non-QM lenders, accept alternative verifications to

tax returns: the rate and terms of those loan programs are not as good as bank

loans.

Providing 24 months of bank

statements is one of the best alternative methods to verify income.

Providing 12 months of bank

statements is also a workable method but with rates and terms inferior to the

24-month bank statements.

Private investors could lend without any verification of income but most

require at least 3 months of bank statements.

David requested a loan by showing only 3 months' bank statements and

could not find a match. Lendersa®

found

loan programs available if David can prove his income with 12 bank statements

instead of 3. David can find a co-borrower to help with the income.

When do we do Optimization

The optimization is done:

a. Instantly when there are no lenders matching your loan request. All you need to do is look at the optimization results and select the option to update your loan request in order for lenders to contact you.

b. You can optimize your request at any time. Even if you get a reply from many lenders but for whatever reason you are not satisfied with the results that you get, you can optimize your loan for better results. Also keep in mind that we are acquiring new lenders every week. So although you may not receive a satisfactory result on your first optimization, waiting a few days or a week may bring about fresh and better results.

Relax

Loans' underwriting guidelines are complicated; there are dozens of factors to consider, and periodic changes by lenders make the subject of lending challenging to grasp. Your loan needs and your financial profile are unique. We built software to save you the headache of transforming an unapproved loan request into a preapproved loan.

All you need to do is optimize your loan request to have several lenders competing for your business.