Get loan approvals with Lendersa Optimization

Are you looking to optimize your loan experience? Look no further than Lendersa. Our platform offers a unique approach to loan optimization, tailoring the loan options to your specific financial profile. We follow a six-step process that includes selecting urgency in loan application, choosing your first priority in loan optimization, determining your second priority in loan optimization, deciding the minimum time for loan duration, selecting the maximum length of prepayment penalty, and utilizing the optimization button. In this blog post, we will explain how our solutions can help you optimize your loan experience and list down the key benefits of using Lendersa for loan optimization. Read on to learn more about how we can help you make informed decisions when it comes to loans.

Understanding Loan Optimization with Lendersa

Loan optimization involves tailoring your loan to fit your financial profile. Lendersa helps optimize your loan through a six-step process, considering factors like credit score and loan type. This can save you money on interest rates and fees. With Lendersa's expertise in loan programs, you can find the best loan for your needs.

The Importance of Tailoring Your Loan to Your Financial Profile

Tailoring your loan to your financial profile ensures it aligns with your unique needs. Consider factors like income, expenses, and credit score to optimize the loan. Personalized loans reduce default risk and improve chances of approval. Lendersa matches borrowers with the best loan options for better terms and affordability.

The Six-Step Process for Optimizing Your Loan

At Lendersa, we have developed a systematic six-step process to optimize your loan. We begin by evaluating your financial profile and loan requirements. Next, our team conducts thorough research to select the best loan options for you, considering factors like real estate, VA, USDA, FHA, and conventional loans. Once the loan is chosen, we assist you with the application and underwriting process. Finally, our goal is to help you close the loan and secure the best interest rate available from financial institutions, private money lenders, or hard money loans. With our expertise and dedication to finding the best rate for you, you can achieve an optimized loan experience.

Selecting Urgency in Loan Application

Selecting the urgency in your loan application impacts the loan processing time, interest rate, and other terms. Lendersa helps set the proper urgency, ensuring a smooth application process and efficient meeting of urgent loan needs. Optimize your loan experience with Lendersa's expertise.

Choosing Your First Priority in Loan Optimization

When optimizing your loan, it's crucial to identify your first priority. This could be a low-interest rate, flexible terms, or a specific loan program. Lendersa guides you in determining and prioritizing your loan goals, ensuring you can optimize your loan to meet your needs with its extensive network of lenders.

Determining Your Second Priority in Loan Optimization

Refining your loan search further involves determining your second priority in loan optimization. Factors such as loan duration, prepayment penalties, and closing costs can be considered as your second priority. Lendersa assists in identifying and prioritizing this goal, helping you find the best loan options and improving your overall loan experience.

Deciding the Minimum Time for Loan Duration

Deciding the minimum time for loan duration is crucial for optimizing your loan terms. Shorter durations often come with lower interest rates, saving you money. Lendersa provides expert guidance in selecting the optimal loan duration, helping you make an informed decision. Balancing loan duration with other priorities ensures a well-optimized loan.

Selecting the Maximum Length of the Prepayment Penalty

When choosing the maximum length of the prepayment penalty, it's important to consider how it will impact your loan flexibility. Longer penalties may result in lower interest rates but limit your ability to pay off the loan early. Lendersa helps you find the right balance for your financial goals.

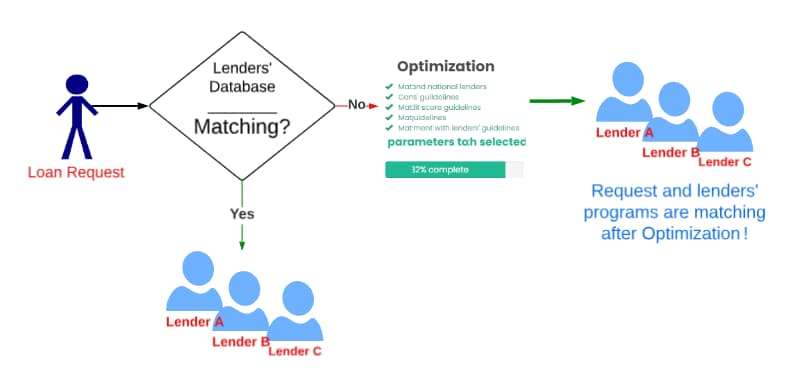

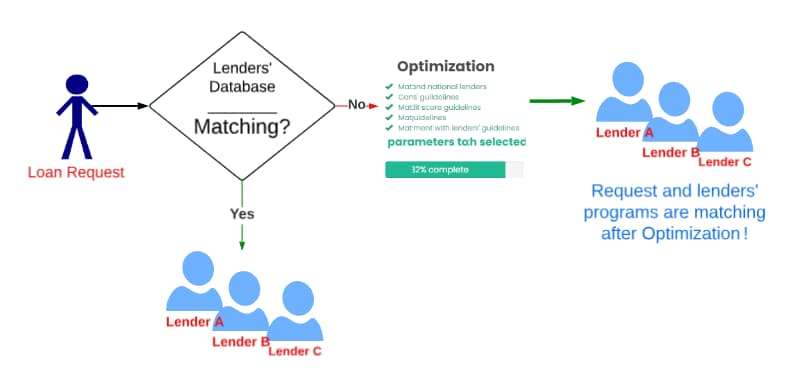

Utilization of the Optimization Button: A Detailed Overview

The optimization button on Lendersa's platform offers a comprehensive overview of loan options. Personalized recommendations based on your profile are revealed when you click the button. By considering factors such as credit score and loan type, Lendersa's optimization tool simplifies the loan selection process. Accessing and utilizing the optimization button is seamless thanks to Lendersa's user-friendly interface.

How can studying the solutions optimize your Loan Experience?

Studying Lendersa's solutions helps optimize your loan experience. By understanding loan options, you can make informed decisions that align with your financial goals. Utilize Lendersa's expertise to find the best loan for your needs and ensure an efficient and tailored loan experience.

Key Benefits of Using Lendersa for Loan Optimization

Access multiple lenders, find the best loan programs, and obtain competitive interest rates through Lendersa. Simplify the application and underwriting process while saving time and effort by comparing loan options. Enhance your loan optimization experience with Lendersa's comprehensive platform.

Conclusion

In conclusion, Lendersa provides a comprehensive platform for optimizing your loan experience. By tailoring your loan to your financial profile and following the six-step process, you can ensure that you are getting the best possible loan terms. Lendersa's optimization button allows you to easily compare different loan options and select the ones that align with your priorities. This not only saves you time and effort but also helps you make informed decisions. Additionally, by utilizing Lendersa's solutions, you can take advantage of key benefits such as competitive loan rates, personalized recommendations, and a simplified loan application process. So why settle for less when you can optimize your loan with Lendersa? Start exploring your options today!