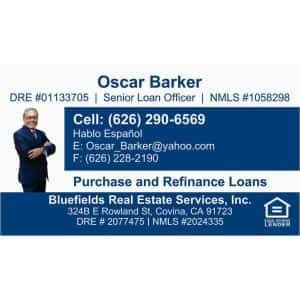

- Bluefields Real Estate Services Inc.

- 324B East Rowland Street, Covina, CA, 91723

- Bluefields Real Estate vision of success is to offer to you highly competitive products so you can benefit the most from them and at the same time that we are not outbid by other lenders We offer to Home Buyers and Home Owners real estate loans to purchase and refinance your property. The loan types we offer are: FHA, VA and Conventional Loans

|

- Lopez Financial

- 315 E San Bernardino Rd, Covina, CA, 91723

- Lopez Financial In business founder of the George Lopez is the Mortgage Broker of company since 1993 broad range of residential and commercial loans. We specialize in first time buyers.Residential and Commercial Financing. Offering all types of loans from Conventional, FHA, and VA loans. Face to Face customer service.

|

- Prominent 1 Financial Group Inc.

- 576 South Barranca Avenue, Covina, CA, 91723

- Prominent 1 Financial Group Inc specialize in all types of financing that will best fit your financing needs. Wholesale Mortgage & Real Estate Broker Owner. I am approved with several Wholesale Direct Lenders, specializing in FHA, VA, Conventional, Jumbo, HUD, USDA and Down Payment Assistance Programs up to 104% Financing.

|

- Royal Homes and Loans

- 658 Shoppers Lane, Covina, CA, 91723

- Royal Homes and Loans is located on Shoppers Lane in Covina CA specializing in buying and selling real estate, home loans, property management and credit correction. We serve Covina, West Covina, Glendora and the Los Angeles County, Riverside County & San Bernardino County, with professional real estate services.

|

- C & S California Capital

- 644 S. Barranca Ave, Covina, CA, 91723

- C&S California Capital was established in 1997 as a Mortgage Broker dedicated to provide informed, exceptional service. In January 2014, we became a division of American Pacific Mortgage. Becoming a direct lender as well as retaining the ability to broker loans, allows us to be highly efficient, diverse and resourceful in caring for our clients.

|

- Lending Enterprise

- 7007 Washington Ave, Suite 311, Whittier, CA, 90602

- Because we truly understand that homeownership is the foundation of our communities and everyone deserves a home for their family, Lending Enterprise is deeply devoted to care, help, and provide the best home loan experience for our customers and business partners, with ethics, win-win mindset, and most importantly, with integrity.

|

- Legacy Capital Funding

- 7007 Washington Ave, Suite 301, Whittier, CA, 90602

- Legacy Capital Funding is proud to be a mortgage broker serving residential clients in the Los Angeles County area. Based in Whittier, we are a small business that provides the level of customer service only an experienced team of professionals can. From our community-focused, educational approach to home loans to our commitment to our clients.

|

- Nationwide Home Loans

- 8152 Painter Avenue, Suite 200, Whittier, CA, 90602

- Our mortgage team members will give you the individual attention you deserve and treat you with the respect due a valued customer. We understand you're making a commitment in purchasing a home, refinancing a mortgage, or tapping into your home equity. So we make a promise to you: we will help you qualify, apply and be approved for the ideal loan.

|

- Nuhome Team

- 440 E Route 66, Glendora, CA, 91740

- "Our mission is to serve our customers with honesty, integrity and competence. Our goal is to provide you with the best terms at the lowest possible cost.

Justin Brown started his mortgage career in 1999, working as a loan processor, underwriter, and operations manager. This back end experience gave him an extensive edge"

|

- PCMortgage

- 1345 South Grand Avenue, Glendora, CA, 91740

- At PC Mortgage, we provide you with quality service and powerful technology ... Jaime Genie Founder of PC Mortgage PC Mortgage breaks down the loan process for new buyers using plain English and easy calculators. We’re a team of real people, not just an online tool. That means we can help regardless of your financial situation.

|