- Bay Equity LLC

- 1812 K St., Sacramento, CA, 95811

- Bay Equity is a full-service retail mortgage lender. Founded in the heart of San Francisco’s financial district in 2007, the company recently moved to new corporate headquarters in Corte Madera, CA. Bay Equity Home Loans is currently licensed in 40 states and is expanding across the nation with retail branches in 27 states.

|

- Optimus Capital

- 1545 River Park Drive, Suite 335, Sacramento, CA, 95815

- Optimus Capital, Inc. offers fast and creative financing solutions for real estate investors, through private hard money loans. As a full-service private money lender, we can help cash flow all your deals while you build up your real estate portfolio Whether it’s for wholesale, a renovation project or ground up construction.

|

- Pacific West Lending LLC

- 14001 North 7th Street, Suite E109, Phoenix, AZ, 85022

- Pacific West Lending was founded in 2017 by Michael Aldridge and Chris Bang, seasoned financial services professionals, and the company specializes in residential lending through a network of funding sources. These sources give the client multiple options in any given scenario, as opposed to being limited to one set of guidelines

|

- Residential Home Loans

- 5751 Sunrise Blvd, Citrus Heights, CA, 95610

- Residential Home Loans, is an established mortgage lender in the Sacramento area. Our office is made up of licensed loan originators dedicated to our business and making the home loan process as smooth as possible. As home loan lenders we are here to assist in all Real Estate Finance needs.

|

- Sterling Mortgage Services

- 5620 Birdcage Street, Suite 210, Citrus Heights, CA, 95610

- Our mission is to serve our customers with honesty, integrity and competence. Our goal is to provide home loans to our clients while providing them with the lowest interest rates and closing costs possible. Furthermore, we pledge to help borrowers overcome roadblocks that can arise while securing a loan.

|

- Elite Loan Advisers

- 3830 Watt Ave, Unit 2, Citrus Heights, CA, 95610

- We are a customer service based mortgage company centered on flexibility and finding the best mortgage option for our clients and their families. We believe each person's situation is different and can help prepare those who are not ready to take the necessary steps within their budget and time frame.

|

- Brian Terrill Lending Company

- 5750 Sunrise Boulevard, Suite 130-A, Citrus Heights, CA, 95610

- We are a licensed finance brokerage that operates in the State of California under the Department of Business Oversight Financing Law. We are also licensed as a Mortgage Loan Originator in the State of California. At times we may refer you to other sources of funding rather than act as the direct broker,

|

- Silver Oak Funding

- 5750 Sunrise Blvd, Suite 210, Citrus Heights, CA, 95610

- Silver Oak Funding, Inc is focused on the Mortgage Broker model of lowest Rate and costs coupled with top service in order to ensure the best client experience possible. The team at Silver Oak Funding is dedicated to “simplifying” the home loan process for everyone involved. Too often in today’s fast paced world

|

- OnPoint Financial, LLC

- 7600 North 15th Street, Suite 150-2, Phoenix, AZ, 85020

- At OnPoint Financial, we ensure we have solutions for every type of homeowner! It doesn’t matter if you are buying your first home, upgrading into your dream home or building wealth buying investment properties – let the experts at OnPoint Financial keep you pointed in the right direction.

|

- Clarke Capital LLC

- 7301 North 16th Street, Suite 102, Phoenix, AZ, 85020

- Curtis Clarke has serviced the Phoenix valley with home loans since 2005. With almost 10 years of service & expertise he knows how to save you the most money with the financing on your home. valley with home loans since 2005. Clarke Capital LLC, offering personalized mortgage solutions, fast customized quotes, great rates & service with integrity.

|

- Travis Credit Union

- PO Box 2069, Vacaville, CA, 95696

- Travis Credit Union works every day to make a difference in the lives of the people we serve. As a secure and trusted financial institution, we advocate for the financial education and well-being of our members, and we give back to their local communities. To date, we have sponsored 200+ charities and local causes and volunteered 13, 000+ hour.

|

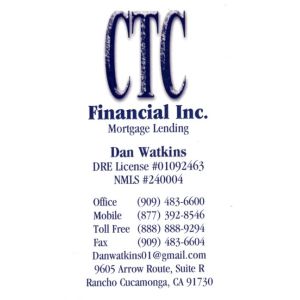

- CTC Financial, Inc.

- 1000 N Carson Street, Carson City, NV, 89701

- CTC Financial, Inc. has been in business since 2002 and serves all parts of California and Nevada. We work with Realtors, Builders, Financial Planners and previous customers. Our commitment to a high level of service, along with a wide range of loan products, is what sets us apart.

|