- Global Fox Financial

- 2511 Buddy Owens Blvd, Suite A, McAllen, TX, 78504

- Global Fox Financial is a private commercial real estate lender and structured finance company that offers financing to borrowers directly and through a network of finance professionals. Global Fox Financial is additionally a partner of Rio Grande Capital LLC, our account receivable brokerage. We feature a variety of commercial loan programs.

|

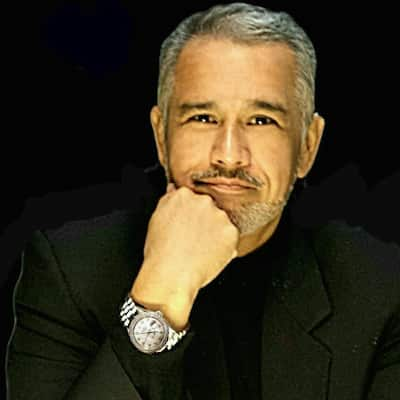

- Diversified Lending Group

- 5412 N. 10th St, McAllen, TX, 78504

- Joe Cuellar, Branch Manager for Castle & Cooke Mortgage in McAllen, Texas, truly knows the ins-and-outs of the mortgage business! Whether clients are seeking alternative ways of generating income through investing in real estate or are simply looking for a home mortgage, Joe is the guy to see. With more than 30 years in the financial

|

- A.A. Genesis Investments, LLC

- 1012 Martin Avenue, Suite C, McAllen, TX, 78504

- Our mission is to serve our customers with honesty, integrity and competence. Our goal is to provide home loans to our clients while providing them with the lowest interest rates and closing costs possible. Furthermore, we pledge to help borrowers overcome roadblocks that can arise while securing a loan.

|

- Mortgage Pros

- 5801 N 10th St, Suite 300, McAllen, TX, 78504

- Mortgage Pros is a mortgage provider, supported by Directions Equity LLC, and based in McAllen TX. We provide residential financing for the purchase or refinancing of residential real estate.We’re a group of highly experienced mortgage professionals. Every team member has extensive mortgage experience and expertise.

|

- Artesia Credit Union

- 210 North Fifth Street, Artesia, NM, 88210

- Artesia Credit Union is a member-owned, cooperative, non profit financial services institution founded and operated to encourage thrift among its members, create a source of credit at a fair and reasonable rate of interest, and provide an opportunity for its members to improve their economic condition in a friendly manner.

|

- First American Bank

- 303 W Main St, Artesia, NM, 88210

- First American Bank serves New Mexico with sixteen full service locations in fourteen communities and mortgage offices in Ruidoso, NM, and Rio Rico, AZ. Over the past century, First American Bank has remained true to its mission by providing a full spectrum of financial services; building lasting customer relationships

|

- MOUNTAIN VALLEY BANK

- 101 N. 6th Street, Hayden, CO, 80487

- Colorado hometown bank with locations in Steamboat Springs, Walden, Meeker and Hayden. We also have locations in Wyoming and Nebraska. Our products include personal banking, business banking, loans, checking, savings, CDs, FREE ATM usage for our customers, Cash Back Rewards, credit cards, mortgage loans, car loans, and ag loans.

|

- Yampa Valley Bank

- 600 South Lincoln, Suite 100, Steamboat Springs, CO, 80487

- Yampa Valley Bank is a truly locally owned Bank serving the people of Routt and Moffat Counties. Our singular commitment to community Banking is reflected in the honest and friendly service provided to all our visitors. It’s what we call Genuine Hometown Banking - it’s who we are.

|

- The Pecos County State Bank

- 500 North Main Street, Fort Stockton, TX, 79735

- The charter of the Pecos County State Bank was dated March 22, 1928. The bank opened for business on July 3, 1928, in the old First State Bank building located on the corner of First and Main in Fort Stockton, Texas. Opening Capital was $25,000.00 with a surplus of $6,250.00. The first officers were J.M. Montgomery,

|

- Del Norte Bank

- 705 Grand Ave, Del Norte, CO, 81132

- Del Norte Bank was chartered as Del Norte Building and Loan Association on May 9th, 1921 by Charles W. Donnen, William Johnson, Louie Eickenrodt, J.H. Weiss, and J.P. Russell. The purpose of the building and loan was to provide a safe place to save money and to offer financing for families to build homes.

|

- Path Finder Mortgage Solutions

- 1109 Nolana Ave, Suite 203, McAllen, TX, 78501

- Path Finder Mortgage Solutions gets you the perfect loan that will fit your budget & lifestyle. With personal attention, we work closely with you to provide you with the mortgage solutions that you deserve. A trustworthy source and reputable mortgage company, Path Finder Mortgage Solutions is headed by Hilda Cardoza and her team of dedicated Team.

|

- Harrison Lending Group, Inc.

- 801 West Nolana, Suite 335, McAllen, TX, 78501

- Harrison Lending Group, we provide custom-tailored lending programs to fit the needs of each borrower and property type. Our many years of experience helps us match your financial profile and property type to the lender's requirements and willingness to fund a particular commercial mortgage loan.

|