- LA Gordon Mortgage Center

- 2350 250 St, Suite 10, Lomita, CA, 90717

- Our mission is to serve our customers with honesty, integrity and competence. Our goal is to provide home loans to our clients while providing them with the lowest interest rates and closing costs possible. Furthermore, we pledge to help borrowers overcome roadblocks that can arise while securing a loan.

|

- Golden State Mortgage

- 2244 Pacific Coast Hwy, Suite 106, Lomita, CA, 90717

- Golden State Mortgages is focused on helping Californians achieve the goal of home ownership. Our goal is to close every loan in 28 days or less. In-house underwriting, processing, and closing allows for fast approval and on-time fundings.Local California mortgage company and provide top-notch customer support.

|

- United Catholics Federal Credit Union

- 160 E College Street, Covina, CA, 91723

- United Catholics Federal Credit Union (formerly St. Christopher’s FCU) was chartered in 1957. Monsignor Bramble and a group of parishioners recognized the benefits of a credit union and through their perceptive vision of finding a way to assist the parish community with their financial needs United Catholics Federal Credit Union was formed.

|

- Radiant Financial Inc.

- 169 E College St, Covina, CA, 91723

- We pride ourselves on exceeding our customer's expectations in finding the best rates, service, and options for a home loan that's right for you. Whether you want the lowest rate possible, a large amount of guidance, or a more complex financing package, we realize you are unique and we'll work with you to form a loan that is exclusively for you.

|

- Futura Financial Inc.

- 750 Terrado Place, Suite 114, Covina, CA, 91723

- The Futura Financial Inc. team is committed to providing clients with the highest quality financial services combined with the lowest rates available in your area. The outstanding mortgage professionals here will work with you one on one to ensure that you get a financial solution that is tailored specifically to meet your financing needs.

|

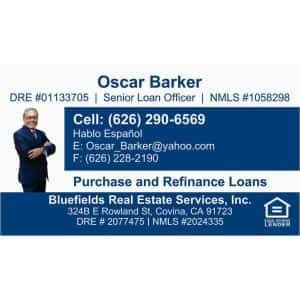

- Bluefields Real Estate Services Inc.

- 324B East Rowland Street, Covina, CA, 91723

- Bluefields Real Estate vision of success is to offer to you highly competitive products so you can benefit the most from them and at the same time that we are not outbid by other lenders We offer to Home Buyers and Home Owners real estate loans to purchase and refinance your property. The loan types we offer are: FHA, VA and Conventional Loans

|

- Lopez Financial

- 315 E San Bernardino Rd, Covina, CA, 91723

- Lopez Financial In business founder of the George Lopez is the Mortgage Broker of company since 1993 broad range of residential and commercial loans. We specialize in first time buyers.Residential and Commercial Financing. Offering all types of loans from Conventional, FHA, and VA loans. Face to Face customer service.

|

- Prominent 1 Financial Group Inc.

- 576 South Barranca Avenue, Covina, CA, 91723

- Prominent 1 Financial Group Inc specialize in all types of financing that will best fit your financing needs. Wholesale Mortgage & Real Estate Broker Owner. I am approved with several Wholesale Direct Lenders, specializing in FHA, VA, Conventional, Jumbo, HUD, USDA and Down Payment Assistance Programs up to 104% Financing.

|

- Royal Homes and Loans

- 658 Shoppers Lane, Covina, CA, 91723

- Royal Homes and Loans is located on Shoppers Lane in Covina CA specializing in buying and selling real estate, home loans, property management and credit correction. We serve Covina, West Covina, Glendora and the Los Angeles County, Riverside County & San Bernardino County, with professional real estate services.

|

- C & S California Capital

- 644 S. Barranca Ave, Covina, CA, 91723

- C&S California Capital was established in 1997 as a Mortgage Broker dedicated to provide informed, exceptional service. In January 2014, we became a division of American Pacific Mortgage. Becoming a direct lender as well as retaining the ability to broker loans, allows us to be highly efficient, diverse and resourceful in caring for our clients.

|