- Kings Mortgage Services, Inc.

- 4244 W. Mineral King Ave., Visalia, CA, 93291

- Kings Mortgage Services, Inc., established in 1997 by Dale Ransdell, Darren Ransdell, and Pam Raeber, is a family owned and operated mortgage banker. After years of working for 'The Big Guys', we opened our doors with the concept of providing our customers with local decisions and exceptional service.

|

- Arrona Financial Real Estate Lending

- 599 Higuera Street, Suite F, San Luis Obispo, CA, 93401

- Arrona Financial Real Estate Lending specializes in getting your home loan funded. From first time home buyers to seasoned investors, Arrona Financial has the experience, knowledge and ability to make your next real estate transaction a smooth one. From purchase money to refinance, we have the loan to fit your needs.

|

- Pacific Trust Mortgage

- 735 Tank Farm Rd. Suite 210, San Luis Obispo, CA, 93401

- Pacific Trust Mortgage was originally founded in 2002 with the genuine belief in creating clients for life. Founded in San Luis Obispo, CA, PTM is rooted in the Central Coast and is fast becoming the preferred lending partner for Realtors, CPA’s, Financial Advisors, and builders alike.

|

- Tucoemas Federal Credit Union

- 614 S Akers St, Visalia, CA, 93277

- Tucoemas Federal Credit Union's roots in Tulare County stretch back to 1948 when nine original members pooled their savings to create our credit union. We've grown steadily since and now offer accounts, real estate loans, auto loans, personal loans and more through four California branches in Visalia, Tulare and Porterville.

|

- Lake Tahoe Mortgage LLC

- 899 Tahoe Boulevard, Suite 500, Incline Village, NV, 89451

- Lake Tahoe Mortgage provides residential mortgage loan origination services throughout all of Nevada and California. Our team is made up of knowledgeable and friendly loan officers with years of experience in the mortgage industry. We take the time to talk to you one-on-one, listen to your concerns

|

- Tulare County Mortgage Services

- 332 East King Ave, Tulare, CA, 93274

- TCMS, we are dedicated to helping residents of CA’s Central Valley get the prompt mortgage and refinancing services they need at rates they can afford. Our loan officers are licensed, experienced & provide the attentive and dedicated customer service and attention prospective homebuyers need in order to make the process of obtaining financing easy.

|

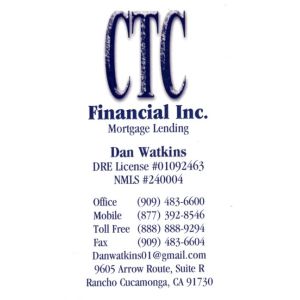

- CTC Financial, Inc.

- 1000 N Carson Street, Carson City, NV, 89701

- CTC Financial, Inc. has been in business since 2002 and serves all parts of California and Nevada. We work with Realtors, Builders, Financial Planners and previous customers. Our commitment to a high level of service, along with a wide range of loan products, is what sets us apart.

|

- Greater Nevada Mortgage

- 4070 Silver Sage Dr, Carson City, NV, 89701

- Greater Nevada Mortgage (GNM) provides home loans in both Nevada and California to assist a variety of borrowers, from investors to first-time homebuyers. GNM services many home loans locally for Nevadans, as well as borrowers in California. Founded in the Sierra Nevada region in 2001.

|

- Home Wealth Funding Inc

- 5595 Kietzke Lane, Suite 100, Reno, NV, 89511

- Home Wealth Funding is a locally owned and operated mortgage company based in Northern Nevada focused on attention to detail, hard work, leveraging the team, building trust, working smart and learning. In addition we need to have fun, enjoy life, give back and above all, provide customers low interest rates.

|