- Triple C Mortgage Inc.

- 138 North 10th Street, Santa Paula, CA, 93060

- Our mission is to serve our customers with honesty, integrity and competence. Our goal is to provide home loans to our clients while providing them with the lowest interest rates and closing costs possible. Furthermore, we pledge to help borrowers overcome roadblocks that can arise while securing a loan.

|

- Northstar Lending Group

- 1657 Hwy. 395, Suite 103A, Minden, NV, 89423

- We are your LOCAL, INDEPENDENT mortgage broker with 50+ YEARS of combined experience serving all of Nevada. The education of our clients is our #1 priority in today’s real estate market. Understanding the type & term of your home loan is extremely important. It is essential to know your mortgage product & interest rate.

|

- Granite West Funding, LLC

- 40879 CA-41, Suite 1A, Oakhurst, CA, 93644

- "Granite West Funding as a locally-based Oakhurst mortgage company, we work with customers in and around Oakhurst as well as throughout the state of California.

Our goal is to get you quickly and affordably into your dream home, and to make the entire lending experience speedy, friendly and easy."

|

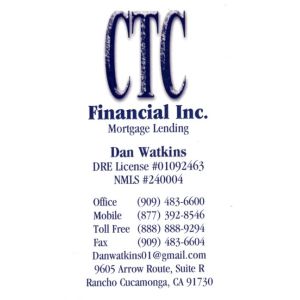

- CTC Financial, Inc.

- 1000 N Carson Street, Carson City, NV, 89701

- CTC Financial, Inc. has been in business since 2002 and serves all parts of California and Nevada. We work with Realtors, Builders, Financial Planners and previous customers. Our commitment to a high level of service, along with a wide range of loan products, is what sets us apart.

|

- Greater Nevada Mortgage

- 4070 Silver Sage Dr, Carson City, NV, 89701

- Greater Nevada Mortgage (GNM) provides home loans in both Nevada and California to assist a variety of borrowers, from investors to first-time homebuyers. GNM services many home loans locally for Nevadans, as well as borrowers in California. Founded in the Sierra Nevada region in 2001.

|

- New Era Services, Inc

- 1340 Sierra Street, Suite 300, Kingsburg, CA, 93631

- New Era Services Inc. We are a full-service mortgage company based in Kingsburg, CA. We specialize in FHA loans, VA loans, and USDA loans in Kingsburg. We also serve the surrounding cities in Fresno County. Whether you are buying a home or Refinancing in the zip code of 93631, we can help you realize your dream of homeownership or save you money.

|

- Gold Standard Mortgage

- 937 Sierra Street, Kingsburg, CA, 93631

- "Gold Standard Mortgage is a family founded business with the vision of delivering THE DREAM of homeownership to local families.

We wanted to bring the “old fashion” customer service back to the mortgage industry. Relying on our core values and service to develop relationships to bring a professional and personal experience to Home Buyers"

|

- Rehaven, Inc.

- 340 East B Street, Port Hueneme, CA, 93041

- Rehaven Many customers were only viewed as a credit score, rather than hardworking Americans, trying to achieve their dream of home-ownership. I knew then, why buying a home was intimidating and daunting. I felt for the customers, because I too, was once a first-time homeowner applicant, with a low credit score and a small down payment.

|

- CBC Federal Credit Union

- 2151 East Gonzales Road, Oxnard, CA, 93036

- CBC Federal Credit Union was established in March of 1952 by a small group of civilian employees working as civil engineers at the Construction Battalion Center (CBC) in Port Hueneme, California, to serve the savings and borrowing needs of the civil employees on base. They applied for and received approval for a Federal Credit Union charter.

|

- Loan Warehouse

- 183 Montgomery Avenue, 2nd Floor, Oxnard, CA, 93036

- Loan Warehouse was created out of the need for our local community of borrowers to have access to wholesale lenders with wholesale interest rates. We shop multiple lenders with one credit pull. You will have access to these lenders through our brokerage, Loan Warehouse, with multiple loan options. You deserve more than one rate & quote & option.

|

- SC Lending Group

- 300 East Esplanade Drive, 9th Floor, Oxnard, CA, 93036

- Nuris Dante is your premier mortgage expert located in Oxnard, California. She prides herself on offering some of the lowest rates nationwide and make the loan process simple, straightforward and fast for borrowers seeking a mortgage in the Oxnard area. Whether you are first time home buyer, purchasing your dream home, refinancing an outstanding.

|

- Westchester Financial

- 300 E. Esplanade Drive, 9th Floor, Oxnard, CA, 93036

- Westchester Financial offers comprehensive consultation to the homeowner or future homebuyer to ensure that, when the ideal conditions exist, you will be positioned to secure the best possible loan program to fit your unique needs Westchester Financial offers comprehensive consultation to the homeowner or future homebuyer.

|