- Redwood Empire Home Loans, Inc.

- 1930 Primrose Drive, Petaluma, CA, 94954

- At Redwood Empire Home Loans, Inc, we treat each customer as an individual, not a number. We don't place you into a loan profile formula created by the banking industry. We use "common sense" and will help you obtain the best loan possible. We represent a wide range of "A" rated lenders with first quality rates to private "hardship" lenders.

|

- FJM Private Mortgage Fund

- 1372 N McDowell Blvd. Suite D, Petaluma, CA, 94954

- Founded in 2012, First Bridge Lending specializes in providing fast and creative debt solutions for both commercial and residential property types. With over 100 combined years of lending and investing experience, the principals at First Bridge Lending understand our borrower’s needs and know how to deliver optimal financing solutions.

|

- Security First Real Estate Finance

- 7263 Willow Creek Circle, Vallejo, CA, 94591

- Our mission is to serve our customers with honesty, integrity and competence. Our goal is to provide home loans to our clients while providing them with the lowest interest rates and closing costs possible. Furthermore, we pledge to help borrowers overcome roadblocks that can arise while securing a loan.

|

- Jyotsna M. Ramaiya

- 2591 Marshfield Road, Vallejo, CA, 94591

- "Licensed since 1992 Jai Ramaiya has helped hundreds of clients reach their mortgage goals whether purchasing

their first home or refinancing their existing property. Jai specializes in Solano County, moving in the area in 1987, she understands the local market and works with many Realtors in the area."

|

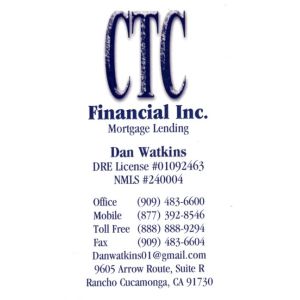

- CTC Financial, Inc.

- 1000 N Carson Street, Carson City, NV, 89701

- CTC Financial, Inc. has been in business since 2002 and serves all parts of California and Nevada. We work with Realtors, Builders, Financial Planners and previous customers. Our commitment to a high level of service, along with a wide range of loan products, is what sets us apart.

|

- Greater Nevada Mortgage

- 4070 Silver Sage Dr, Carson City, NV, 89701

- Greater Nevada Mortgage (GNM) provides home loans in both Nevada and California to assist a variety of borrowers, from investors to first-time homebuyers. GNM services many home loans locally for Nevadans, as well as borrowers in California. Founded in the Sierra Nevada region in 2001.

|

- Lend4less

- 2209 Hartvickson Lane, Valley Springs, CA, 95252

- Lend4less Inc is located in Valley Springs, CA, United States and is part of the Activities Related to Credit Intermediation Industry. Lend4less Inc has 4 total employees across all of its locations and generates $303,475 in sales (USD). Experience the Difference working with a highly skilled lender who cares about your needs

|

- ELOAN4HOME

- 4578 Feather River Dr, Suite D, Stockton, CA, 95219

- "At Eloan4Home. We look forward to getting you approved for your home purchase or refinance!

Here at Eloan4Home we strive to give you the best mortgage service available in today’s market – easy, convenient, and with exceptional client service. We strive to take the mystery out of mortgage for our customers."

|

- Majestic Mortgage Services Incorporated

- 3520 Brookside Rd, Suite 171, Stockton, CA, 95219

- At Majestic Mortgage Services, Inc., our mission is to set a high standard in the mortgage industry. We are committed to quality customer service - putting the people we serve first. Our goal is to carefully guide you through the home loan process, so that you can confidently select the best mortgage for you

|

- East Bay Capital

- 3406 Zaccaria Way, Stockton, CA, 95212

- We have been helping home owners, investors and commercial property owners since 1984. Our mission is to serve our customers with honesty, integrity and competence. Our goal is to provide real estate and real estate loans to our clients while providing them with the lowest interest rates and closing costs possible.

|

- Golden Castle Loans

- 646 Port Chicago Hwy, Suite 5391, Baypoint, CA, 94565

- The GCL Team is committed to providing clients with the highest quality loan origination services combined with the lowest interest rates and closing costs possible. Whether you are looking to buy your dream home or refinance, our experienced mortgage professionals are here to work with you one on one to ensure your success.

|