This guide will help you find the most optimum commercial hard money lender in your area in two essential steps

1. Locate the ten most qualified commercial hard money lenders. Start now

2. Present your request and negotiate to find the winning Lender. (Presentation and negotiations can be done online through your lending portal at Lendersa® )

Commercial Hard Money Axioms

If you understand how commercial hard money lenders think, you will become more successful with your loan request.

Here are the A-Z most essential rules and mechanics that form the backbone of all commercial hard money loans:

- Private investors fund commercial hard money lenders' loans.

- Commercial hard money lenders love to arrange loans and will look at any possible avenue and will turn every stone in an effort to approve your loan.

- Hard money lenders' 1st priority is to ensure the investors will be protected and get all their principal and interest back if the loan defaults.

- Protected equity is the difference between the property value and the loan amount. Lenders assume that in default, foreclosure, and bankruptcy, the lenders could recover their investment if there is enough equity to protect them.

- The protected equity should cover unpaid interest payments, foreclosure, legal costs, costs associated with selling the property, real estate commissions, escrow, title, and legal fees. It can also cover the potential of property devaluation in case of market price declines.

- The protected equity is measured by the percentage of the loan amount divided by the property value, and it is called Loan to Value Ratio or LTV

- The lower the LTV, the better the loan is secured. Conversely, the higher the LTV, the lesser the loan is secured

- 60%-65% LTV is considered to be a safe Loan to Value by most commercial hard money lenders

- Commercial hard money loans with LTV Under 60% are easy to get. Loans with LTV above 65% are more difficult to obtain.

- When commercial hard money lenders expect the real estate market to be strong or stable a year or so past the loan maturity date, they feel comfortable increasing the LTV slightly.

- When the real estate market is in decline or undergoes a period of uncertainty, the commercial hard money lenders will reduce the loans max LTV they are willing to lend.

- Commercial hard money loans are typically arranged for a short duration of 6 to 60 months. And mostly 12 to 24 months

-

The purpose of the commercial hard money loans is:

1. Speed- Get a loan quick (Bank loan can take 3-6 months to arrange, hard money loan can take 7 to 30 days to close)

2. Qualification-Get a loan that banks cannot do because of credit, income, property conditions issues, or other bank guidelines conflicting with the borrowers' qualification or the property

- If the LTV is low enough, lenders will arrange the commercial hard money loan regardless of any other underwriting issue. ( no credit, bad credit, no income, no verification, property half-built, any other matters)

-

The LTV determine if the commercial hard money loan can be done, but many other factors affect the Rate & terms:

Borrower's needs:

Max LTV (Loan Amount)

Max CLTV

Speed of Approval

Funding time

Loan duration

Interest rate

Monthly payments

Prepay penalty

Point and fees

Loan extensions provision

Underwriting flexibilities:

Income

Verification of income

Can't verify down payment

Liquid assets (cash in the bank stocks, bonds, etc.)

Net worth personal and business

Credit issues

Title issues

Property location issues

Property condition issues

Blanket loan; Additional properties

Appraisal issues

Co- borrowers issue

- None of the above issues (o) will prevent the commercial hard money lender from arranging the loan as long as the LTV is low enough and a title company can insure the property. When it comes to commercial hard money loans, LOW LTV IS KING.

- It is harder to appraise commercial properties than residential properties. There could be a wide range of opinions about the value of a commercial property among different lenders. Appraising commercial properties could be 10X more complex than appraising a single-family resident. An appraisal report is an opinion of value, and giving an appraisal assignment of a refinance of single commercial property to 10 different appraisers will bring 10 different values.

-

LTV is not an absolute value because the commercial property market value is not absolute. The property value depends on the Lender's opinion of value or an appraiser's opinion of value. Different lenders may assign a different market value to the same property; thus, if the loan amount requested is not changing, the LTVs will be different.

In this example notice, 3 different lenders come up with 3 different LTVs for the same property and the same loan amount

|

Loan Amount |

Lender’s estimated Property Value |

LTV |

| Lender A |

$500,000 |

$800,000 |

62.50% |

| Lender B |

$500,000 |

$750,000 |

66.66% |

| Lender C |

$500,000 |

$680,000 |

73.53% |

- Since 2009 residential loan lenders have been required to select appraisers randomly from a large pool of appraisers. The CFPB enacted that rule to make sure banks, lenders, and other financial companies treat you fairly. But commercial hard money lenders are not bound by this CFPB rule and are at liberty to choose any appraiser they wish. Some appraisers are more conservative than others, and hard money lenders have the power to select appraisers for specific tasks that could influence the property value, the LTV, the loan amount, and Rate and terms. On some loans, the lenders are not even required to get an appraisal.

- Because the LTV is the most critical aspect for the commercial hard money lenders and because the commercial property value is more subjective than residential properties selecting the right Lender becomes a significant issue that impacts loan approval to a great extent.

- Intelligent borrowers will try to shop a commercial hard money loan with at least 3 local commercial hard money lenders. Although most lenders will need to get an appraisal done on the commercial property before the loan approval, most lenders could give the borrowers a general idea of the market value. The borrower can then decide which Lenders to select. Find the top 10 commercial hard money lenders that fit your loan need.

-

Here is an example demonstrating how the valuation of the property in the eye of the Lender affects the loan approval and pricing. The table shows a simplified rate sheet of two lenders and the approval of the results based on two different appraisals. Lender A rate sheet show higher interest rates than Lender B. Lender A appraised the property for $2,340,000, which is 64.10% LTV and enabled the borrower to obtain a loan amount of $1,500,000 at 8.00%.

|

LTV- Rate Sheet |

Loan amount |

Appraised |

LTV |

|

60% or less |

60.01%-65.00 |

65.01%-70.00% |

70.01%-75.00% |

| Lender A |

7.50% |

8.00% |

9.00% |

10.50% |

$1,500,000 |

$2,340,000 |

64.10% |

| Lender B |

7.00% |

7.50% |

8.00% |

N/A |

$1,500,000 |

$2,100,000 |

71.42% |

According to the rate sheet, Lender B will not fund any loan since his LTV is 71.42% based on a lower appraisal of $2,100,00.

If the borrower agrees to reduce the loan amount to $1,400,000, Lender A will have a better rate of 7.50% than the Rate of 8.50% from lender B.

If, however, the borrower requests a loan of only $1,250,000, then lender B will have a better rate of 7.00% instead of the Rate of 7.50% offered by lender A.

|

LTV- Rate Sheet |

Loan amount |

Appraised |

LTV |

|

60% or less |

60.01%-65.00 |

65.01%-70.00% |

70.01%-75.00% |

| Lender A |

7.50% |

8.00% |

9.00% |

10.50% |

$1,500,000 |

$2,340,000 |

64.10% |

| Lender B |

7.00% |

7.50% |

8.50% |

N/A |

$1,500,000 |

$2,100,000 |

71.42% |

|

| Lender A |

7.50% |

8.00% |

9.00% |

10.50% |

$1,250,000 |

$2,340,000 |

53.41% |

| Lender B |

7.00% |

7.50% |

8.50% |

N/A |

$1,250,000 |

$2,100,000 |

59.52% |

The above example assumed that it is the same property, borrower, loan duration point fees, and other terms are the same. It also assumed that both lenders could perform the loan fast and close simultaneously. In reality, the situation could be a lot more complicated. Speed of funding and easy qualification is often more important than the interest rate. The takeaway lesson is that one must not rely on one Lender or even two or three. When it comes to commercial hard money lenders shopping the loan to as many as ten lenders can be very fruitful. Lendersa® portal searches over 750 commercial hard money lenders and keeps records of your interactions to ensure that you get the best possible loan. Start now

- Most commercial hard money lenders arrange loans in 1st position only. Only a small percentage also arrange loans in 2nd position or 3rd position. For the lenders to agree to arrange 2nd or 3rd position loans, the lenders must carefully examine the senior liens, and LTV usually is lower, below 65%.

-

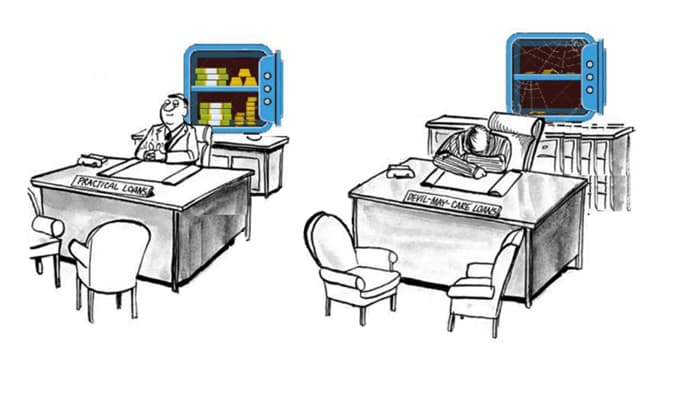

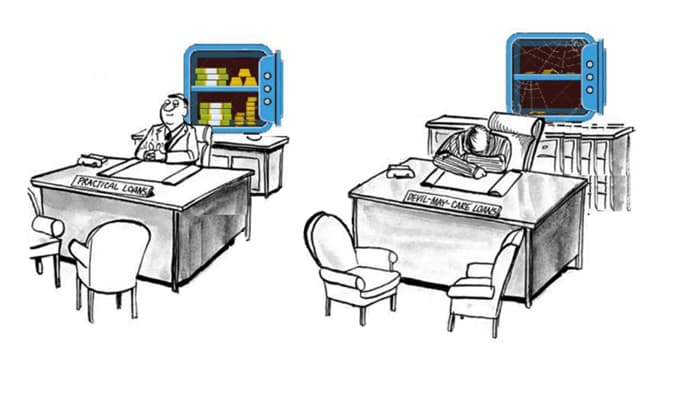

Hungry lenders are aggressive commercial hard money lenders that will bend policy to make the loan. Lenders become aggressive when their private investors pressure them to lend or are just inherently enthusiastic about getting business and helping people. Lenders become dormant when their investors are taking it easy and tend to be overly conservative. On the other side of an eager beaver-hungry Lender, you find the sleepers whose energy is just too low to get your loan done.

- In practice, lenders fluctuate with their eagerness. One year, a very outgoing lender could become very inactive the following year, and vice versa, a sleeper could come to life as a lion beating all other lenders' pricing and very aggressive on approving loans with high LTV. If Borrowers have a tool to spot the hungry lenders and avoid the sleepy ones, they will be successful in their quest for the loan provides you with the application to select the most active lenders with the best loan programs.

- Besides the A-Z of commercial hard money lenders above, there are other considerations that, although not as common as in the above, could alter the fate of your loan request. Lendersa® Loan score and Lendersa® Loan Improve application cover other issues to help you get the most optimum loan for your needs. Start now

Find commercial hard money lenders in your state:

More references about unconventional loans: